In part one of this series, I took an in-depth look at the broad technological trends driving disruption and economic uncertainty for music's creative class over the past two decades: an explosion in supply meeting relatively fixed demand, growth in catalog on streaming services, and a fundamental inequity in the balance of power between creators and corporations.

In part two, I examined the concurrent changes in music's demand side, with a particular focus on the rise of unlimited, all you can eat streaming and algorithmic curation on the world's leading music platform, Spotify.

In this final chapter, we'll tie together these parallel storylines alongside a careful consideration of the power aggregators wield in our digital economy and where music is likely heading in the next decade.

Always Be Aggregating

There are few concepts more key to understanding our present digital age than those of aggregators at scale. Whether in music, video, shopping, social media, or other verticals, aggregators exert a profound gravitational pull over everything – and everyone – in their path. While the mechanics of digital aggregators have been widely discussed over the past decade in tech circles, I suspect most fail to realize just how much power Spotify – music's über aggregator – wields over individual musicians and their livelihoods.

No writer has considered the nature and impact of aggregators more carefully than the creator of Aggregation Theory himself, Ben Thompson. Thompson has churned out such a high volume of brilliant tech analysis in his revered newsletter, Stratechery, that it is hard to do his work justice in a few short sentences – but I'll try.

According to Thompson, digital aggregators – such as Amazon, Netflix, the iOS App Store, AirBnB, and Spotify – represent a discrete class of oligarchs from their pre-digital predecessors due to one underlying factor: scale. Specifically, modern aggregators benefit from the unique economics of digital goods, which can be both reproduced and distributed to billions of consumers with zero or near zero marginal costs.

Music provides a prime example: in the pre-digital age, the only way for record labels to sell recorded music was the labor-intensive process of manufacturing physical product. Most crucially, this task carried non-trivial costs for creation (creating the album), reproduction (making one CD versus one billion) and distribution (shipping one CD versus one billion). While pre-digital businesses always wanted to sell more goods, there was a hard cost to doing so; the secret sauce was in building a supply and distribution chain that maximized the profit by keeping incremental costs as low as possible.

The internet changed this paradigm entirely. In many cases, the upfront cost of creation still remains, although for some it has dropped dramatically as we explored in part one of this series. The real disruption, however, occurs in the other two parts of the value chain: reproduction and distribution. The cost of reproducing a bit of code one time versus one billion is practically identical – it is essentially zero. The same applies to digital distribution: at scale, bandwidth costs are virtually nonexistent compared to the bygone days of shipping physical product.

This last bit – the near zero cost of distribution – is particularly key here. HMV and Tower Records had to lure you into their physical retail stores in the 1990s, if you were even lucky enough to live near one; Spotify merely has to get you to download an app, wherever you are in the world, enabling direct connection at scale with hundreds of millions or billions of consumers. This, crucially, relocates the center of power from content suppliers (artists and record labels) to content distributors (streaming platforms). Combined with the propensity of technology to democratize creation and increase the supply of goods – which undermines the leverage each supplier has, while concurrently strengthening the hand of the distributor – these dynamics mean platforms, not creators, now hold nearly all of the power.

If you've paid attention to the Epic Games vs. Apple lawsuit over the past year, you've seen this process in action. Apple's App Store – which is the only place to get applications for the ubiquitous phones that are now chosen by nine of ten American teenagers – is one of the world's most dominant aggregators. The company, at its sole discretion, is able to set terms which suppliers (app developers) must conform to if they wish to have access to Apple's unmatched digital distribution channel. When a supplier – even an enormous one, such as Fortnite developer Epic – dares to challenge the aggregator, the consequences are typically swift and severe. For the aggregator, a rebellious supplier is merely one of an interchangeable million who can be easily replaced; for the supplier, the aggregator is the singular chokepoint for access to a billion consumers – there is no Plan B.

One of the most pernicious aspects of digital aggregators is the ways in which they – intentionally or entirely unintentionally – exert the power which was once the impetus for the advent of U.S. antitrust law in the early 20th century, while avoiding the 'consumer harm' standard used to pursue antitrust enforcement in the post-Bork era. Apple is an instructive case here. To hear Apple tell it, if a developer doesn't like the terms of their App Store, that individual or company is perfectly free to go publish their app on Google Play or another competitor – so what's the problem?

Only it's not quite that simple in reality: if you're an app developer without access to Apple's install base, you aren't really an app developer. Similarly, musicians have, in theory, many digital platforms to publish their works to: TuneCore, a leading artist services company, currently offers distribution to over 150 stores. The problem, however, is identical to that of our unlucky app developer: you can and should publish your music everywhere, but if that everywhere doesn't include Spotify, you essentially don't exist. If you think I'm being dramatic here, I urge you to try releasing a song and not distributing it to the platform – I can guarantee, from personal experience, that the first comment on your Twitter or Instagram post will be "why can't I listen on Spotify?"

Is this Spotify's fault? Not in a classical sense, no; the company has not, to my knowledge, taken any anti-competitive actions against rival platforms beyond the normal sharp elbows of the business world. Spotify has rather built a best-in-class consumer product that exhibits strong user retention and network effects, which is responsible for their market-leading dominance.

This raises a question which is increasingly top-of-mind in tech circles: is it fair to regulate or punish a platform which is great for end users but perhaps unfair to its suppliers? Does anyone want to use the fourth best maps app and end up with their car in a river in the name of equality and 'fairness'? I don't believe that is a wise way to approach Spotify specifically. My goal in examining the platform is merely to better inform artists and fans about how aggregators work, and let them make a conscious decision about which one they want to use as a result.

Notably, aggregators can, in some cases, become subject to aggregation themselves. Spotify is again an instructive example here: as an app publisher, the company is subject to Apple's App Store rules just like everyone else. As it turns out, even über aggregators tend to dislike aggregation when they end up on the other side of the distribution channel – Spotify is currently suing Apple, leading a brave cohort of app publishers calling for antitrust regulation of the App Store in Europe. There is a good bit of irony here: the company is openly rebelling against the same lack of control and self-determinism in the App Store that it exerts on suppliers (artists) on its very own platform.

To be clear, I do not believe Spotify is a monopoly, and I applaud the company for leading the fight against unilateral App Store control. Even without the existence of a monopoly, however, the presence of one immensely powerful aggregator in music is increasingly driving a devaluation of the art form itself, leaving artists with little choice but to comply with increasingly concerning asks and product changes from the dominant platform, which we'll discuss shortly.

In this next section, we'll examine how the combination of algorithmic curation and music's aggregation at scale is playing an increasingly concerning role in the financial and artistic well-being of musicians.

The Commoditization of the Song

Parts one and two in this series established two critical facts about the streaming music economy in 2021. More songs (supply) are being produced than ever before; simultaneously, the past decade has shifted the locus of control over listener consumption from the sovereign user (Anderson's search box) to the platform (editorial and algorithmic curation).

If you recall our earlier discussion of Spotify's algorithmic classifier – the process by which a song, and the musician who created it, are abstracted to qualities such as 'speechiness' and 'energy' – you may sense where I'm going next. Whereas each original song in the history of music is, at least to some degree, a unique creation unlike every other, the same is not true of classifier parameters. Given a large enough dataset, two (or more) songs can most certainly have identical values for acousticness, danceability, and loudness, among other variables. They are, algorithmically speaking, virtually interchangeable.

The true legacy of Songza is most certainly not an acquisition by Google: it is the abstraction of music as an art form into moods, activities, and 'vibes'. In this paradigm, the song isn't merely freed from the context in which the creator released it (an album, EP, or single); this atomic unit of music becomes a commoditized object which an algorithm can use to achieve a desired result or end state. If you're listening to a Good Vibes playlist, do you really care what songs are in it, or about the artists who made those songs, so long as it sounds a certain way? Most likely, no: you're simply chasing a feeling (as I often do!) and a mass of commoditized music is the hammer with which you'll hit that nail.

When we zoom out to a macro view of Spotify as the über aggregator for music, this pattern of interchangeability only becomes more prevalent, and does so far beyond mood playlists. The shift to algorithmic discovery – your Discover Weekly, Release Radar, and Fresh Finds playlists – represents a larger thematic development in the past decade of the music business. Songs and artists are becoming commoditized and interchangeable, useful mostly in their suitability to be queued up for insertion into a playlist because an algorithm believes they have a similar qualitative profile to something you favorited last week. Furthermore, this privilege of interchangeability only applies to artists who already have enough engagement for the algorithm to deem them relevant. For many in music's ultra long tail, the proper term isn't interchangeability: it is invisibility.

This trend – and the platform's power to exert it – is further compounded by the explosion in supply we examined in part one of this series. While a streaming ecosystem with only a handful of artists – as opposed to the eight million plus on Spotify now – would not represent a 'better' outcome, it would most certainly reduce the leverage the company can exert on its suppliers as an aggregator at scale. Losing one supplier when you have five is a nightmare; losing one thousand when you have eight million is utterly irrelevant. To be sure, some suppliers can throw their weight around more than others – Taylor Swift has certainly done so in her up-and-down history with Spotify, to great media interest. Eventually, however, with enough scale, the aggregator always compels one to bend the knee: it's worth noting that Swift's full catalog has been available on the service for some time now, even though no material changes in artist compensation ever materialized.

The notion that artists are becoming commoditized, interchangeable zeroes and ones is not merely speculation on my part: recent scandals involving 'fake artists' show that, at least in some genres, the problem is demonstrable. Over the past several years, credible outlets have laid out persuasive evidence showing an uptick in Spotify playlist additions (and streams) for artists that appear to be little more than a profile picture and a made up name. This practice appears to be most widespread in lean-back moods and playlists, such as Deep Focus, Sleep, and Peaceful Piano.

As Tim Ingham explains in a phenomenal 2019 piece on the subject, the suspected fake artists enjoy curiously prominent placement in major Spotify playlists despite having zero presence anywhere on the internet: many have accrued over 100M plays each, placing them in Spotify's most elite tier of artists.

Why would the service potentially condone such behavior, much less support it prominently in leading playlists? As with everything in the music business, the answer is likely simple: money. Most suspect that the label administering such works struck a lower-rate royalty deal with Spotify, allowing the company to siphon bits of revenue away from the major labels and improve its margins incrementally. Curiously, many of these suspected fake artists are signed to labels and publishing administration companies based in Sweden – the same country where the service was founded.

Particulars aside, the fact that seemingly fake artists have not just invaded the leading streaming platform – but are actually thriving on it – suggests that interchangeability and commoditization of the creator is very real indeed. While the superstars of the world may not be easily replaced with a lower-royalty impostor in Today's Top Hits, the same cannot be said for the less fortunate – read: nearly all – musicians on the service.

Spotify's dominant market power is also responsible for the limited success efforts to unify creators in protest of the company's treatment of artists have found to date. It isn't a complex problem: with eight million suppliers, and increasingly more being added every day, there is always another artist (or several million) waiting in the wings if and when one decides to boycott the platform.

The legacy of piracy, which fundamentally undermined the notion that music has intrinsic monetary value in the eyes of millions of consumers, makes this issue even more acute. Unions, for all of their issues, 'work' because many workers together are far more powerful than any one alone. In music, however, where workers are used to making some number approaching zero off of their art, there is not just a dearth of collective bargaining: there is no precedent for fair pay. Musicians are told to prioritize 'exposure' above making a living in their early days – the dirty secret of our industry, however, is that even with exposure, that promised payday will likely never arrive from streaming alone. As a result, there remains an endless supply of creators ready, willing, and able to fling themselves onto the flywheel of devaluation in hopes of making that prominent shiny playlist. This is not a criticism because I know this process first-hand.

In my earlier summary of Ben Thompson's Aggregation Theory, I left out one crucial detail: merely aggregating mass amounts of content does not make one an aggregator. Instead, true digital aggregators are defined by their ability and willingness to exert pressure – especially around pricing – on their suppliers. As it turns out, Spotify is doing precisely this as 2021 comes to a close through two primary mechanisms: a pivot away from music to be the platform for all 'audio', and Discovery Mode, a promotional scheme that promises increased exposure in exchange for lower royalty rates. In the next two sections, we'll explore how these forces – the latter of which has already triggered Congressional inquiry – are combining to exert significant pressure on the platform's artist community.

Music ≠ Audio

If the issues we've covered so far were the only ones facing artists in the streaming economy of the next decade, their battle to earn a decent living would most certainly be an uphill one. In reality, however, I fear a much more substantial obstacle – one which is now just in its infancy – will further challenge the livelihoods of the eight million creators who distribute their music to Spotify: the company's pivot from music to audio.

Several years ago, I began noticing something odd in the company's investor and marketing materials: wherever possible, the the word 'audio' was now where 'music' had been before, a trend that has only grown since:

It's hard to demarcate exactly when this began happening, but I'll admit that at first, I paid the change little mind. Much as the word 'creator' has curiously supplanted 'artist' in many settings, I figured audio was merely the hot term du jour in tech and media circles. While Clubhouse would bring the term firmly into the zeitgeist in 2021, Spotify's changes weren't just syntactic sugar: they were a roadmap for the dramatic changes coming to the world's most dominant music platform.

What is the difference between music and audio? Music, of course, is any form of musical content, whether that is a Taylor Swift single or a classical opus. Audio – an expansive category by comparison – comprises just about anything else you can possibly listen to, with a particular focus on podcasts and audiobooks. To understand why this distinction is so key, we first need to contextualize Spotify's business within its larger ecosystem.

In the years following Spotify's aforementioned shift to algorithmic curation, the company has enjoyed remarkable, hockey-stick like growth: Monthly Active Users (MAU) grew from 68M in Q1 2015 to an eye-popping 286M in Q1 2020, later surpassing 380M in Q3 2021. In many ways, the company checks all the boxes for a once-in-a-decade blockbuster startup: massive disruption of a legacy industry, near-exponential growth, and a wildly successful public market IPO. In one key aspect, though, the company is relatively unique in the world of powerful startups: unlike most software-driven businesses, its marginal costs are directly correlated to platform growth. In other words: as users grow, costs grow significantly as well – the opposite of how most Silicon Valley cash machines work.

Why is Spotify unlike most other highly successful software startups in this regard? That one is simple: rights-holder payments, which consume nearly 70% of topline revenue, are a far cry from the rich profit margins found in many venture capital funded decacorns. For all my criticisms of the company's current treatment of musicians, I will give credit where it is due: Spotify has managed to carve out not just a business, but rather an industry-leading business, in a vertical where most competitors operate as loss leaders for enormously profitable parent companies. In contrast to Apple Music, Google Play Music, YouTube, and Amazon Music, Spotify cannot merely operate as a marketing and customer-retention vehicle in disguise: it must generate a profit off of nothing but music streaming alone.

It's this last bit – being profitable at scale in music streaming – that may well be one of the most difficult feats to pull off in the business world. If you own the world's most impressive distribution network for music content, however, there just so happens to be a remarkably effective way to tip the scale back in your favor: replace listening time spent on royalty-bearing music with royalty-free podcasts and audiobooks instead.

Shortly after I noticed 'audio' popping up more frequently in the company's press materials, Spotify's true ambitions came into much sharper focus with the combined $404M acquisitions of Gimlet, Anchor, and Parcast in 2019. These mega-deals were followed by a subsequent $235M acquisition of podcast advertising leader Megaphone in 2020; blockbuster content deals with Joe Rogan ($100M+) and Call Her Daddy's Alexandra Cooper ($60M); and most recently, an acquisition of digital audiobook distributor Findaway for an undisclosed sum in late 2021.

One need look no further than Spotify's most recent quarterly financial release – or splashy interviews with its CEO – to see how pivotal non-music content is to the company's future ambitions and pitch to investors. Daniel Ek's presentation below reads like one from the head of a podcast service, not one that is the financial backbone of the modern music industry. Three of the four feature callouts on the second slide are focused solely on podcasts, not musical content.

Q3’21 earnings results are out. @Spotify had a very strong quarter and I feel good about where we stand across the business. Thanks to the team for continuing to deliver. https://t.co/LyCpSiZTUO pic.twitter.com/ABwLGAgFxs

— Daniel Ek (@eldsjal) October 27, 2021

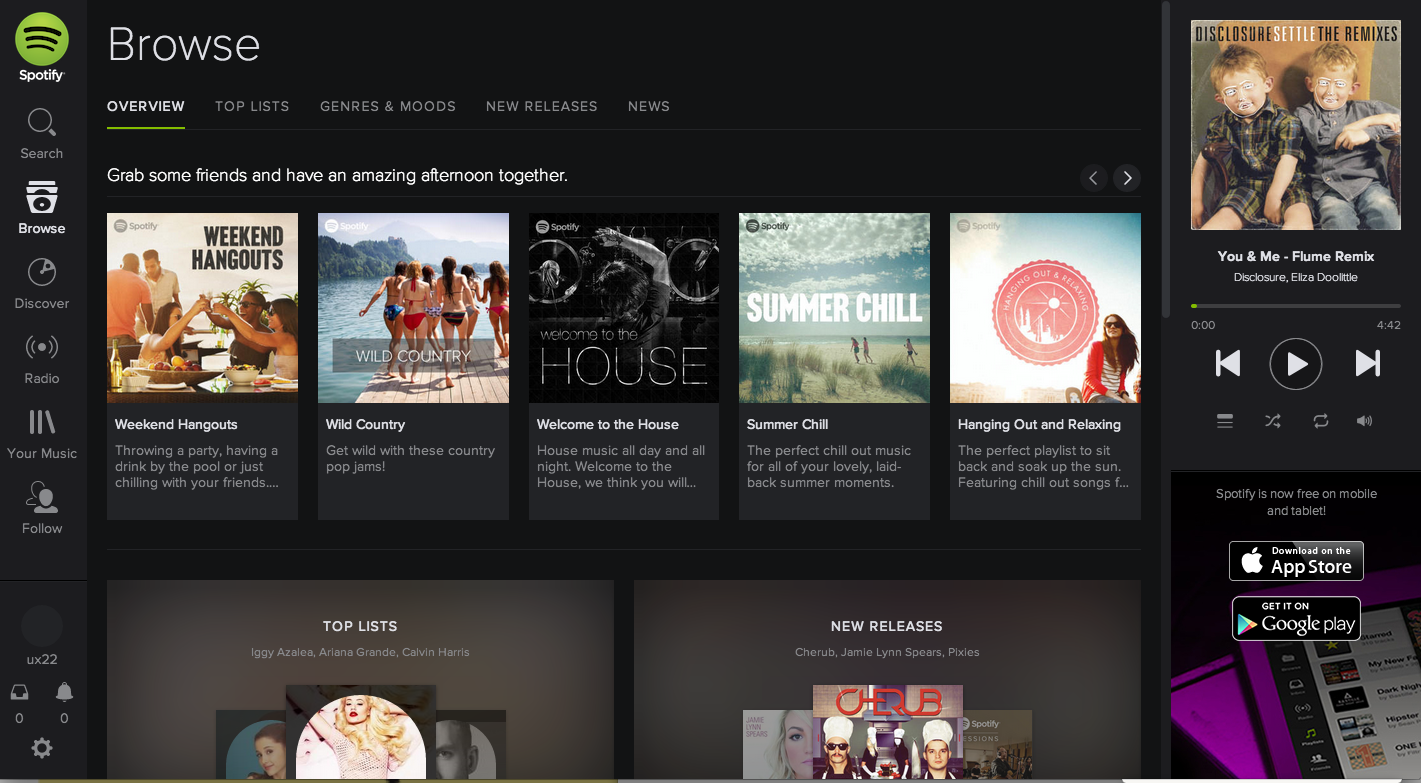

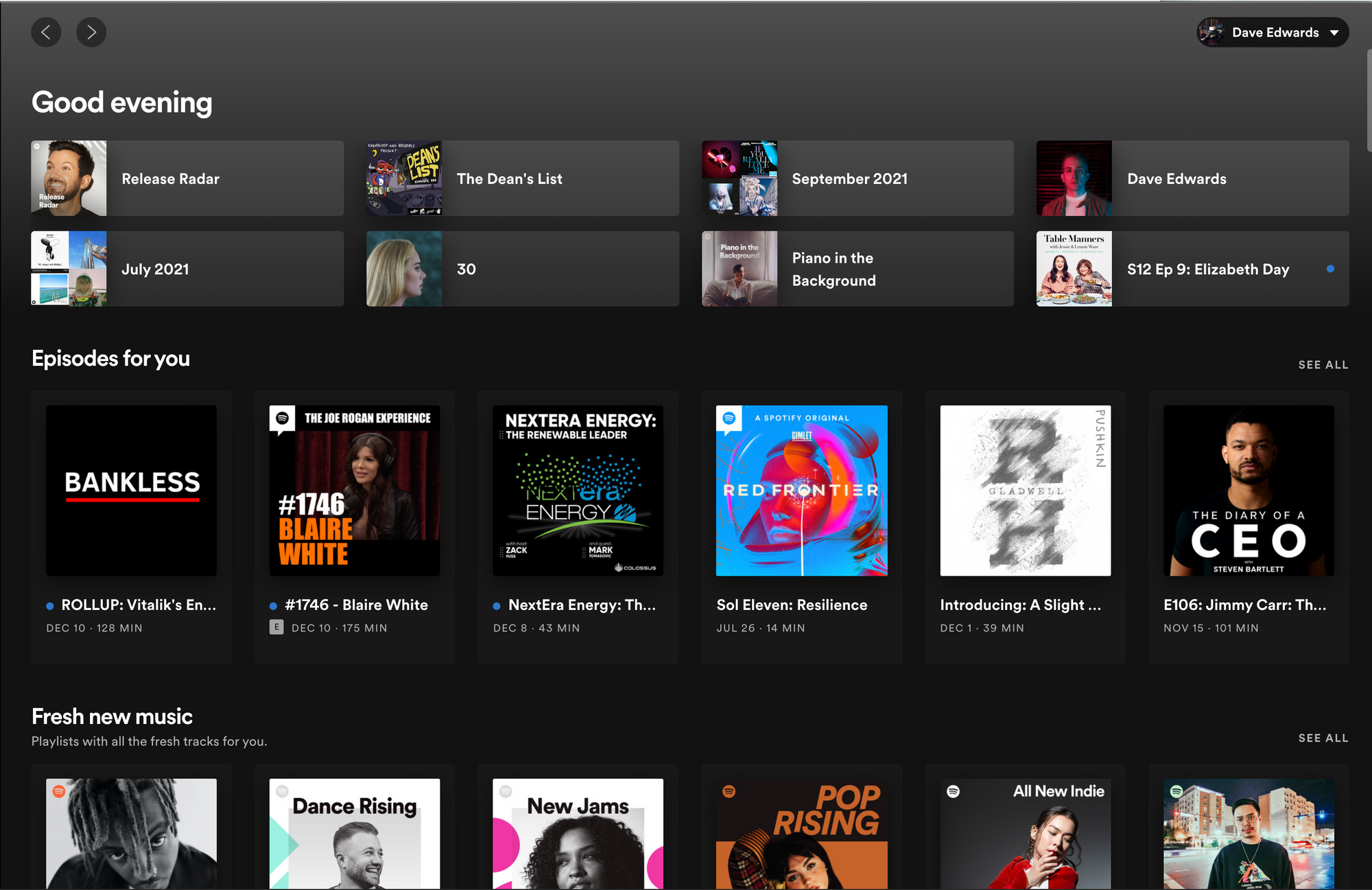

My true concern with Spotify's pivot, however, is not the substance of press releases and investor decks: it is the ways in which the platform's core design and user experience are being reworked to displace loss-leading music content with higher margin long-form audio. Whereas opening the Spotify app in 2014 revealed an interface filled with nothing but music, the company's current design uses prime visual real estate to feature algorithmically-recommended audio content to the user:

I've written recently about how fierce the fight is for consumption time – particularly for users under 34 – in our modern Attention Economy. Gaming, on-demand video streaming, and short form social video apps like Tik Tok are continuing to eat the world, while music's hold on our attention spans appears more ephemeral than ever. Short of a piracy revival, the last thing struggling musicians need in their quest to make a living off their art is the industry's leading streaming platform deciding that music just isn't really worth all the trouble anymore. Spotify's most recent earnings report indicates this is far from an idle concern: podcast share of total listening hours hit an all time high in the quarter, with gross margins beating estimates due to "a favorable revenue shift towards podcasts" among other factors.

Spotify's design evolution, in fact, is only the most obvious shift in how the platform views – and treats – its two main supplier cohorts, musicians and podcasters. In the next section, we'll examine a major under-the-hood change which went unnoticed by most in music this year, and what it tells us about the nature of aggregators, the future of music, and who truly holds the power on the world's leading streaming platform.

Musicians As Second Class Citizens

Aside from its SEC mandated quarterly and annual reports, Spotify's Stream On event offers more insight into the company's roadmap and ambitions than any other source – and 2021 was no exception. One of the most important aspects of this year's presentation – and one which received virtually zero attention from musicians and music press – was the announcement that creators would soon be able to offer subscriber-only podcasts using Anchor, which the company acquired in 2019.

At first glance, this likely seems like a particularly irrelevant detail to a discussion of the future of music on Spotify and, by extension, streaming at large. A closer look, however, offers a powerful indication of the increasingly divergent treatment of musical artists and podcasters on the platform, as I wrote on Twitter shortly after the official news broke in April:

This great @benthompson piece on Spotify's new Podcast Subscription product got me thinking about how stark the differences are for artists and podcasters on their platform, the future of music, and what we value in the creator economy.

— Dave Edwards 🎧 (daveedwards.eth) (@itsDaveEdwards) April 30, 2021

A thread 🧵👇🏻https://t.co/gk0FWd7yAE

Part of what made this announcement so hard to parse for the average musician is its technical nature, so let's simplify the news into language everyone can understand. In short, Spotify's new Open Access platform offers podcasters the ability to sell subscriptions to exclusive content and memberships on their own website while also allowing subscribers to consume that exclusive content within the Spotify app. I know this might not seem important yet – stay with me here.

If you've followed the music business for the past decade, you've likely noted the rise of startups like Patreon and their increasing role in helping musicians better monetize their fanbase given the lackluster economics of streaming. Patreon, OnlyFans, and similar platforms allow creators to sell recurring memberships – think of it like a modern fan club – for highly engaged fans in exchange for exclusive songs, content, and other perks.

Notably, Patreon has carved out a particularly large business around both podcasters and musicians: the company is currently valued at over $4B following a fresh round of fundraising led by Tiger Global in April 2021. Although the two creator cohorts are technically selling a different product, the net effect is the same: fans fork over a monthly fee in exchange for exclusive access and special content. Fans get to support their favorite creators, creators get to make more money, and everyone (in theory) goes home happy.

Only it's not quite that simple in reality. As I noted earlier, Spotify's position as the über aggregator for music has real consequences for musicians: if content isn't on the platform, it effectively doesn't exist for a majority of fans. This experience – a fan wanting to engage with your music or content but not being able to do so on their own terms – is a terrible user journey.

While Patreon and the like have indeed become a buzz-worthy topic in music, such platforms are still employed by a relatively small number of musicians. Anecdotally, I strongly suspect the reason why is the disconnect I describe above: asking someone to pay an extra $10 for exclusive content is a much harder sell when they can't enjoy said content on their favorite streaming app, and if we're playing the odds, that app is Spotify.

This is where the company's Open Access announcement made my ears perk up. As I digested the news, I realized the company had – intentionally or not – effectively created two classes of creators on their platform, offering podcasters significantly more than musicians with regard to owning the fan relationship outside of Spotify. Examining the rights offered to each type of creator is telling.

With the launch of Open Access, podcasters are able to sell their own subscriptions on an external website – and in so doing own the customer relationship – while allowing their fans to consume and interact with all of their content, exclusive or not, within their favorite streaming app, Spotify. Owning this customer journey is particularly crucial: it means the creator owns the billing relationship (credit card info), enjoys pricing flexibility (the creator sets the price), and has a direct line of communication to the buyer (email/SMS), the latter of which is so powerful that an entire ecosystem of thriving startups exist around it. Simultaneously, podcast creators get to enjoy all the benefits of being on Spotify – including the chance to be picked up by the mighty discovery algorithm and reach thousands or millions of new listeners.

Where do musicians stand in comparison? Well, we can't do any of those things. Open Access doesn't allow artists to sell memberships externally and make their subscribers happy within the Spotify app, unless we want to also become a podcaster in addition to managing a music career. Because musicians can't leverage the power of differentiated pricing with custom memberships – we instead have to take the royalty rate Spotify dictates – we also don't command anything resembling the power of podcasters to determine the value of our work. And while we can, in theory, sell memberships on Patreon, OnlyFans, or the next patronage platform to emerge, the fundamental disconnect I described earlier – which is a frustrating experience for your most loyal fans – notably remains.

This divergence in creator rights on Spotify is an important lesson in the power and behavior of aggregators. If you're curious why the company doesn't feel the need to extend these rights to musicians just yet, I have a very simple answer for you: they don't need to, but they certainly do with podcasters – for now, at least. Whereas the platform is the be-all, end-all aggregator for over eight million artists – essentially every individual releasing music in the world – it is very much climbing uphill against the comparatively open-standards world of podcasting, which isn't yet aggregated by anyone. While the company enjoys unmatched leverage over musicians, it currently holds little over podcasters; as a result, one type of creator is being prioritzed over the other.

Spotify is investing in game-changing tools for podcasters because they want to aggregate the world's audio, which will only happen if they provide the best experience for podcast creators. The company's treatment of its currently aggregated vertical, however, should give the podcast industry pause about what it will likely mean for its content, and creators, if Spotify is successful in doing so.

As part of its Open Access announcement, the company said it would take a zero percent fee of subscription revenue for Anchor-published podcasts for two years: in 2023, however, a five percent fee will be introduced. While a 5% fee is quite low, this is classic 'corner the market, then raise the price' methodology. It's also worth noting that the 'independent creators' the company refers to in the following quote, publicized during the release of Open Access, are most certainly podcasters, not musicians:

Too often, the portrayal of Spotify and its executive leadership – particularly the CEO – resembles a cartoonish caricature akin to Dr. Evil in the Austin Powers series. To hear some in music tell it, especially on Twitter, Ek and his co-workers are intentionally siphoning off every cent they can from the music business. Despite my ample criticism of the company, this hasn't been my experience. I've met wonderful people who work at Spotify, all of whom love music and work hard to create a fantastic consumer product. For all of my qualms with the platform's monetization of music, I similarly don't believe the company is making a pivot to audio out of animus towards musicians or even the major labels: they are doing so more out of necessity.

In financial circles, Spotify has a not-so-quiet secret: its Average Revenue Per User (ARPU) has been declining for years. Remember those gaudy subscriber growth numbers I mentioned earlier? While they're unquestionably impressive, they also happen to be largely driven by extended free trials, low-cost introductory deals, and bundle offers such as the company's family subscription plan. Earlier this year, Rolling Stone noted that the average Spotify premium subscriber is paying less than $5 per month for the right to stream every song ever made – less than half of the $10 per month price point most consumers associate with the service. In its most recent quarterly earnings release, however, the company reversed this trend ever so slightly, pulling in $5.03 per subscriber – a four percent gain driven, at least in part, by increased share of listening time on podcasts, not music.

On a macro level, we can also understand the apparent necessity of Spotify's podcast pivot by comparing the company to its most analogous competitor in video, Netflix. In my opinion, the most significant difference between the two companies is not the media they deliver: both music and video, after all, are just binary ones and zeroes traveling near the speed of light through fiber optic cables to consumers.

It is far more illuminating to consider the fundamental difference in the cost basis of content for each streaming provider. Netflix, crucially, does not pay an incremental, per-stream royalty to most content owners every time you stream a 007 movie or episode of Seinfeld; rather, the company typically secures blanket licenses in specific territories for each piece of content, and said fee is the same whether that particular video is streamed one time or one million. Spotify, of course, is held to very different standards with music. Although the notion of a 'per-stream' royalty is technically inaccurate due to the pro-rata accounting we covered in part one, the gist is correct: every time a song is streamed on the service, you can be sure a rights-holder is getting paid one way or another. To become the 'Netflix of audio', then, the company must fundamentally shift its business model from aggregating content which carries per-stream payouts to formats which carry upfront licenses, if anything at all.

While Spotify appears quite intent on becoming the destination to stream the world's audio, there seem to be a few notable exceptions in the company's conquest for content: perhaps coincidentally, these outliers have royalties associated with their use. In the past month, the company has found itself embroiled in a fresh controversy over creator pay far outside the music business, this time with comedians:

Spotify just dropped comedians (without warning) because they refuse to pay royalties around literary copyrights (rights that comics are legally owed, and musicians are already paid).

— Joe Zimmerman (@joezimmerman) November 29, 2021

Spotify is now a 47 billion dollar corporation, that pays artists next to nothing (cont'd)...

We can best understand Spotify's current content ambitions, then, as being the world's audio* repository: *all audio is welcome, so long as it does not carry an incremental or usage-based cost.

Enter podcasts – an audio-based media format which just so happens to not have any precedent for a per-stream royalty, nor labels or collection societies legally required to enforce such measures. While I don't condone Ek's recent statements or share buybacks while most artists make next to nothing, I certainly understand his newfound joy for podcasts and other royalty-free audio. It is only through content ownership and flat-fee licensing – the Netflix model – that Spotify is likely to create a highly profitable and enduring business for its shareholders and employees.

This conclusion, however, is deeply unsatisfying to myself and nearly everyone in music – and it should be. How is it possible that our industry, whose creators generate a larger cultural impact than any other form of media or entertainment, cannot be monetized effectively enough to sustain an independent streaming platform at scale? Furthermore, how is running a profitable and sustainable streaming business so difficult at a time when musicians already earn next to nothing? Is music simply doomed to a future in which we rely on benevolent tech behemoths to subsidize loss-leading streaming applications?

I don't believe so. We'll soon examine the enormous shifts in expectations around platform ownership, creator monetization, and variable pricing which may offer a real chance at a better future for the music business. Before we do so, however, we'll need to consider one final aspect of Spotify's current business model: its newfound willingness to exert its pricing power as the world's most dominant music aggregator.

The Flywheel of Devaluation

As I previously noted, one does not become an aggregator by merely amassing a large quantity of content: in our digital economy, this distinction belongs only to those who actively exert pricing pressure over their suppliers. In 2020, Spotify took by far its boldest step yet to do precisely that, with deeply concerning implications for the future of both musicians and the recorded music business.

Having been in the music industry – a vertical notorious for its almost comical power imbalances – for the last two decades, it's exceedingly rare that corporate announcements make me audibly gasp. Gasp, however, I did, upon reading Spotify's announcement of Discovery Mode, a 'promotional' mechanism for musicians which would make the payola progenitors of the twentieth century proud indeed.

In short, Discovery Mode offers musicians and labels on the platform a simple proposition: accept a lower royalty rate on specific songs for a chance to be exposed to more listeners via Spotify's algorithmic recommendations. Forget, for a moment, Amazon's treatment of third party sellers, Apple's policies for App Store developers, and Google's handling of competitors in search: if you want to understand what modern aggregation looks like, it is hard to find a better example than Spotify's latest foray into royalties.

Discovery Mode's direct ask – lower payouts at a time when most musicians are already starving – isn't merely troubling in and of itself. Rather, it is the second-order effects of such a scheme that should give the entire music industry pause. To understand why, we need only consider the core dynamics of a platform where eight million suppliers are moderated by one singular entity in their quest to capture user attention and listening share.

The true threat is the speedy race to the bottom that Discovery Mode creates for Spotify's content providers. In a digital prisoner's dilemma, the platform's new promotional scheme creates a flywheel effect: as soon as one supplier takes the bait and agrees to reduced royalties in exchange for exposure, every supplier who does not do so is disadvantaged as a result. At both the micro and macro level, listening time – and consumer attention, by proxy – are very much a zero-sum game: time spent consuming one of Spotify's 60M+ songs ipso facto means one supplier won, while eight million others lost. Consequently, the moment one content provider opts in, the pressure on every other supplier increases incrementally as a result. In time, as the number of artists who acquiesce increases, the pressure on those still holding out only grows, creating a vicious cycle which nearly all will, sooner or later, find themselves forced to participate in.

In a bit of encouraging news, the company's attempt to further destabilize the objective value of music was quickly met with widespread pushback from artists, press, and legislators alike. The House Judiciary Committee is currently investigating the practice; leading publications including Rolling Stone, Billboard, and Pitchfork have openly compared the offering to the illegal payola schemes of the 1990s; and scores of artists have taken to social media to decry the mechanism.

A careful study of aggregator behavior, however, shows that only two groups hold the power to dissuade Spotify from abandoning the feature: legislators and users. Aggregators do not answer to suppliers; they are commoditized and hold little if any power individually. Nor do they answer to the press – if judgement from journalists were enough to reign in the worst excesses of our current economy, the digital landscape would look far different than it does today.

In the next section, we'll finally tackle the optimistic part of this series: what can be done to create a better future for musicians, rights-holders, and the music industry at large. I'll jump ahead, however, and make my first recommendation now – if you are a Spotify subscriber who cares about the livelihood of the artists you love, make your voice heard. Whether that is on social media, an email to the company, or with your wallet, you are still capable of determining how the Discovery Mode story ends.

I noted earlier that Ek's portrayal by some in music is akin to a super-villain drawn straight from a James Bond flick – one I do not tend to agree with. On this topic, however, I won't mince words: I don't know what the company was thinking with this announcement. From the perspective of both timing – months after an unprecedented pandemic decimated the main source of revenue for most musicians – and substance – a plainly exploitative cash grab while the company was authorizing a billion dollar share buyback to enrich shareholders – Discovery Mode is a deeply flawed proposition.

Music's Next Decade

In this final section, we'll consider the emerging trends, concepts, and movements within both technology and music that offer reasons for optimism as we head into what I believe will be the Streaming 2.0 era. As these topics are complex, I will do my best to summarize here; I will cover many of them (and others) more deeply in future issues of Above The API.

Additionally, because it's always fun to look like a fool on the internet, I will grade each of these trends according to two criteria: potential impact and likelihood of widespread adoption by 2030. While attempting to predict the future is often a fool's errand, I do believe there are strong indicators showing that many of these concepts are well on their way to becoming reality.

Platform Ownership for Creators

Impact: 10 out of 10 | Likelihood: 10 out of 10

In my book, there is currently no more significant trend – both inside and outside of the music industry – than the increasing discussion concerning the need for creators to own equity in the platforms which they supply with content.

The Web 2.0 era – from roughly 2004 to present day – has given us many incredible innovations, products, and platforms, many of which saw particularly widespread adoption following the exponential growth in smartphones after 2007. YouTube, TikTok, Snapchat, Spotify, Facebook, Instagram, Twitter, Substack, and numerous others have empowered creators across the world at previously unimaginable levels of scale. In doing so, the platforms themselves have amassed trillions of dollars in value for shareholders and parent companies alike.

There's just one problem with that: the creators who make the billions of videos, photos, songs, blogs, and tweets that generate said value don't own anything. While some of the aforementioned platforms have taken more credible steps than others in offering creator funds and monetization programs for artists and contributors, consumption based payouts do not capture the full value of creation: only equity in the platform itself does. Less you doubt this is the case, remember our discussion of Spotify's stock ownership in part one: Daniel Ek made more in equity gains in 2020 than every rights-holder on his platform combined did in usage-based royalties. Equity is power; royalties are penny fractions.

However you may feel about Web 3 – the next generation of the internet, which proponents argue will be largely driven by widespread adoption of blockchain technologies – it is already clear that the rapidly growing sector has catalyzed a fundamentally new conversation around creator rights. In Web 3, platform ownership for contributors is the norm, not the exception. DAO's offer a potentially novel corporate and organizational structure with distributed ownership; nearly all blockchain networks and protocols incentivize participation with tokens; and play-to-earn games are forcing the gaming industry to radically rethink the economics of the publisher-player relationship.

Web 3 is in its infancy and many of these structures have clear downsides which have already emerged; they are not a panacea for our creative ills, and there will be highs and lows in the likely shift from centralized platform ownership to a more distributed ecosystem. At a thematic level, however, this trend represents the most promising development for those seeking a better future for creators of all kinds of content.

Furthermore, the notion of platform equity for creators need not be the exclusive domain of Web 3 startups; there is nothing whatsoever blocking traditional Web 2 companies from establishing creator shares based on usage, contribution popularity, or other criteria. I can tell you with certainty that legacy platforms are already pursuing these goals. Regardless of the underlying tech stack, broader ownership will likely unlock enormous amounts of value for the very creators said platforms cannot survive without.

Exportable Social Graphs

Impact: 10 out of 10 | Likelihood: 7 out of 10

One of the most pernicious aspects of Web 2.0's inherent centralization – think Twitter, Facebook, or YouTube – is the ability for a single individual or platform to utterly destroy a creator's livelihood overnight.

I can speak to this first-hand: I once had my SoundCloud account deleted, along with over 10,000 followers (when 10K followers was a lot!), over an unlicensed remix at an especially pivotal time in my music career. On the very day my account was deleted, I was riding high from the most successful release I've ever had – the timing could literally have not been worse. I was getting introduced to managers who would go on to lead friends to global superstardom, booking bigger gigs than I'd ever had before, and growing my followers by leaps and bounds day over day – and just like that, the music abruptly stopped.

To be clear, I shouldn't have been posting anything without a license: I am by no means arguing for getting rid of the copyright system and turning the internet into an IP free-for-all which doesn't respect the wishes of rights-holders. This experience, however, taught me an invaluable lesson about how precarious the life of a creator can be: in the Web 2 era, your career is only as real as your biggest platform says it is. Most importantly, creators aren't always removed from platforms for legitimate reasons. As Facebook's (er, Meta's) recent action towards one particular Instagram user showed, the most any banned creator can hope for is a sympathetic ear at the New York Times: otherwise, there's no 1-800 number to call, and you're out of luck.

Broadly speaking, most popular Web 2 platforms are built around some form of a social graph, which maps the connections between users on a single network. If you follow me on Twitter, our social graphs are connected; if I follow you back, even more-so. Social graphs are how tech giants process and make sense of the billions of interdependent relationships between users on their platforms: the graph shows who you follow, who follows you, and reveals a great deal about how you spend your time on said application.

The problem, however, is that a centralized entity can delete or block any single node – like the @metaverse handle on Instagram – at its exclusive discretion. In a world where a creator's followers quite literally are their livelihood, this has troubling implications across a wide range of industries.

The problems engendered by platform centralization and discrete social graphs also extend far beyond blocks and bans (justified or not), as any creator who invested their time into amassing a large following on Vine will tell you. Put yourself in the shoes of an artist with one million followers on the day the platform shut down: is it your fault that things went awry? No. But unfortunately, that doesn't matter – you either need to pray you can re-establish yourself on another platform (which could, in turn, shut down itself), or find a new line of work.

This level of dependence on a singular platform is about to be put out to pasture. One of the most exciting concepts emerging in the world of Web 3 is that of decentralized and portable social graphs and messaging protocols, such as XMTP. Such systems will likely have wide-reaching effects for creators and fans alike; no longer will you be tethered to a singular application just to follow or be followed by a set group of accounts.

If you recall our earlier discussion of the power of aggregators, you can likely see why such a development would be so crucial for creators of any kind. The concept of platform lock-in experienced by content suppliers – such as musicians distributing their music to Spotify – changes radically if your audience can seamlessly follow your activity from one app to the next, without starting from scratch. Instead of relying on user inertia and lock-in, platforms will be forced to constantly compete based on features and product: if they don't, a better app, with all of your existing social relationships, will be just one click away.

There will be downsides to this development as well. Banning hate speech, CSAM, and other deeply problematic materials that proliferate on the internet may well become far more difficult. Bad actors may benefit from a 'universal social graph', in which a Twitter ban no longer equates to a loss in following and influence. I acknowledge these are major issues we need to confront and solve for, but I do believe that consensus mechanisms can potentially offer practical solutions at scale – with enough attention to detail and policy input from users, regulators, and creators themselves.

Problematic materials aren't the only potential issue with decentralized social graphs: they may fly directly in the face of stringent privacy regulations such as Europe's GDPR and California's CCPA. Legislators and regulators will have a major impact on the real-world feasibility of such systems, which is why I rate this trend as a seven out of ten on a 'likelihood of happening' scale.

Open-Source or Interchangeable Algorithms

Impact: 9 out of 10 | Likelihood: 9 out of 10

As this series has discussed in great detail, many of music's current woes owe to the increasing dependence of both platforms and their users on algorithmic curation. These algorithms – whether powering Tik Tok's viral videos or Instagram's non-chronological feed – increasingly compose the very fabric of our digital lives, and they are ripe for disruption.

I believe we are nearing a tipping point in the evolution of digital platforms: the algorithms driving them are likely to become interchangeable and configurable by the user. Jack Dorsey, who until recently served as Twitter's CEO, is a major proponent of this vision, and I suspect an increasing number of social media and content apps will be pressured to move in a similar direction in the coming years.

While the underlying technology of such an evolution is complex, the practical application is simple: interchangeable algorithms would allow the user to determine how content they view is curated and sorted. In music, you may in the not so distant future have the ability to select an algorithm that skews your discovery experience more in favor of the long tail and away from the fat head of creators: such applications will likely offer customization within a singular algorithm itself, similar to how one might adjust the RGB balance of a computer monitor today. Turn a knob, find more independent artists with less than 10,000 followers; move a slider, and you'll be exposed to more creators from traditionally underserved communities or regions.

As with every other development in tech, such a future could also veer in a more dystopian direction. Filter bubbles are very real in Web 2; I have no doubt that bad actors will offer users who wish to bury their head more firmly in the sand on a host of issues a plethora of options to do so in Web 3. Within the arts specifically, however, the concept of algorithmic portability and interchangeability offers much to get excited about.

Capturing the Demand Curve - NFTs, Dynamic Pricing, Micropayments, and Patronage

Impact: 8 out of 10 | Likelihood: 9 out of 10

Chris Dixon's canonical piece on the tragic pricing inflexibility of the Web 2.0 era – written, incredibly, in 2012 – is a valuable read for understanding the promise of the new financial rails arriving in Web 3, offering many applications to the outdated revenue models of the music business.

The power law distributions discussed in part one of this series aren't only present when dissecting the stream counts of artists on platforms like Spotify; similar patterns show up when examining the general economic distribution of an artist's fanbase itself and any individual fan's propensity to spend money to support that creator. Put more simply: musicians are most often floated by the outsize support of the few over the minuscule support of the many. In any given fan population, a relatively small subset of consumers will produce most of the economic output: everyone might listen, but far fewer buy your most expensive merch drops.

The Web 2 era can be characterized by a near-universal adherence to single, inflexible price points: whether the platform is free or $9.99 a month, exceedingly few platforms at scale currently allow creators to experiment with variable pricing to capture more of the economic demand curve and cater directly to their super-fans. Whereas numerous failed Web 2 startups tried to monetize the super-fan in a separate, discrete app from where content consumption actually occurs, Web 3 streaming platforms will lead with this feature built-in.

In some cases, this will manifest as Non-Fungible Token (NFT) sales; in others, it may be dynamic pricing, where a die-hard fan can pay extra to consume gated content exclusively, or early, before the long tail of listeners do.

Watching Succession on Sunday got me thinking about one of the most exciting promises of web3: variable payments to creators/rightsholders.

— Dave Edwards 🎧 (daveedwards.eth) (@itsDaveEdwards) October 19, 2021

Why? After the ep, I thought about how I'd pay a lot to watch the rest of the season immediately.

A 🧵 on why I think this will be so big

For many platforms, this will have nothing to do with Web 3: Audiomack, the company where I currently work, recently launched a direct-donation mechanism for fans to support artists as they stream, and I anticipate this will soon become widespread – no blockchain required.

There are, of course, many potential pitfalls here. Early NFT sale data indicates that the staggering transaction volumes making headlines in 2021 may be heavily influenced by wash trading and incentivized participation from the newly-rich, for whom blockchain currencies like Ethereum and Solana are more akin to monopoly money than fiat. NFT's also present legitimate environmental concerns in some of their current iterations, although this varies widely depending on the underlying blockchain being utilized and is a more nuanced issue than Twitter would have you believe. NFT adoption and participation from the long tail of consumers is likewise far from certain: recent skirmishes between developers and users of video games, chat clients, and coding schools have exposed the extreme hesitance of many towards anything crypto-adjacent.

NFT oligarchy? A study of 6.1M NFT trades finds a few folks at the center of the market

— Ethan Mollick (@emollick) November 30, 2021

🐱 The top 10% of traders account for 85% of transactions & trade at least once 97% of all assets

🦍10% of buyer–seller pairs have the same volume as the remaining 90% https://t.co/V3vytqZZB5 pic.twitter.com/IDr67zl7TI

Whether or not the coming demand-curve revolution is powered by cryptocurrency, however, is immaterial for me. I firmly believe that one way or another, creators will benefit from a host of novel monetization mechanisms in the coming decade. While crypto-maximalists and their equally fervent detractors argue on Twitter about what the future looks like, the real operators are out there building and shipping product – regardless of the payment rails underlying it.

Higher Priced Streaming Subscriptions; The Dissolution of Music's All You Can Eat Bundle

Impact: 5 out of 10 | Likelihood: 5 out of 10

No discussion of music's future economic landscape would be complete without stating the obvious: what if we could just get people to pay more than ten bucks a month? This radically simple solution doesn't require blockchain technology, new micropayment infrastructure, or environmental destruction. It requires something much more difficult: price flexibility from the consumer.

On a wide range of issues – most notably climate change – many people 'want' to fix a problem; exceedingly few are actually willing to spend money to do so. Decades of behavioral, economic, and social science research show that wanting to support a good cause is by no means equivalent to an actual propensity to do so financially.

One of the most simple fixes to the woes of modern musicians – moving the price point for 'all you can eat' streaming to $20 or $30 per month – is also the least likely to succeed in my opinion. Subscription fatigue is already here and very much real; the last thing the average consumer wants to do is spend more to merely get the same bundle of content they already enjoy access to for less. In music, this difficultly is especially profound. Few other content verticals have a comparable legacy of piracy, which fundamentally untethered the art form itself from any perceptible intrinsic value on the part of the consumer. To be clear, I would personally like to see unlimited music consumption priced higher than it currently is: I just don't believe the market will bear it.

Will Spotify raise prices for all users once its conquest of audio is complete? Perhaps, but I'm skeptical this would create significant incremental revenue for the music business specifically; if podcasts, audio, and video are the pretense for a price hike, it stands to reason that the bulk of the company's concurrent content investments will focus on those categories instead of music. Successful companies don't pour money into their margin-destroyers: they instead find ways to trim the fat and relentlessly pour gasoline (capital) on the fires already burning the hottest.

Streaming's Endgame

If you've been trying to parse the meaning behind the title of this series – and the 20,000 words behind it – it's time for me to demystify what exactly this has all been about.

The Streaming 1.0 era – broadly defined from Spotify's 2011 U.S. launch to current day – has saved the music industry from the abyss of piracy but has failed to save the financial wellbeing of most musicians themselves. As I noted in part one, this isn't exactly news: just about everyone in music has considered streaming's limited financial utility for artists as a foregone conclusion, choosing instead to focus on ancillary revenue streams such as touring, merch sales, and brand deals. Far from enabling one million artists to make a living at their passion, we wind down our current era with millions of artists fighting to make this job work.

Decimated in the wake of the ongoing pandemic and its destabilization of the live music industry, these artists are not merely being failed by acts of God; they are likewise left underserved by platforms and an industry which are producing extractive and concentrated – rather than widely distributed – gains and wealth.

If this sounds harsh or overly dramatic, go talk to artists you know. Once you push past the brave face most put on as part of their artistic persona, you're likely to find acute desperation and fear that whatever we've built over the past two decades is a future that won't sustain them and most of their peers.

Can streaming support all eight million music creators? No, and it shouldn't have to. Just as putting a stir-fry on the stove once doesn't make one a professional cook, some non-trivial percentage of those eight million aren't looking at music as a profession; it is unfair and reductive to imply that platforms must support every single individual who wants to make music. As this series has (hopefully) clearly demonstrated, however, that is not our primary issue: the problem is that streaming is failing to support the overwhelming majority of creators, even those with large followings and who take their work very seriously.

It is my hope that the Streaming 2.0 era – a time characterized by shared platform ownership, algorithmic interchangeability, variable pricing and novel monetization mechanisms, and decentralized social graphs – will offer a far better future for a much larger swath of musicians. The benefits of such an evolution will not accrue to creators alone. Enormous, profitable businesses will be built around offering these tools to artists; in so doing, I believe they will make some of the top platforms of our current day look archaic and sclerotic in comparison.

This time around, however, value need not only accrue to those at the very top of the food chain: we have a chance to create an ecosystem in which the many, not the few, can capture value from the art which they create. Whether you are a fan, investor, label exec, or builder, go find a way to be a part of that change.