In the summer of 1997, Karlheinz Brandenburg, a gifted German mathematician and electrical engineer, made his way to a meeting in Washington, D.C. that – although few realized it at the time – would arguably change the music business more than any other in history.

Brandenburg, often referred to as the "Father of the MP3", was among the first outside of those steeped in mid-90's Internet Relay Chat culture to realize that his seemingly defunct invention – the MPEG Layer 3 audio format, which had been left for dead in 1995 after a crushing battle with electronics giant Philips – had taken on a second life as the format of choice for music pirates. A technologist through and through, he understood the gravity of the situation. The accelerating deployment of broadband internet, distributed networks, and personal computers meant that music's traditional gatekeepers, the major record labels, were about to lose control of their most important asset: copyrighted music.

Brandenburg arrived at the D.C. headquarters of the Recording Industry Association of America, the music industry's powerful and well-funded lobbying arm, to warn of impending peril. Earlier that year, he and his fellow engineers had devised a potential solution to the metastasizing threat of the MP3, embedding Digital Rights Management into an updated format to give rightsholders more control over their works. Surely, he reasoned, the major labels would jump at the chance to get ahead of what appeared to be a growing threat.

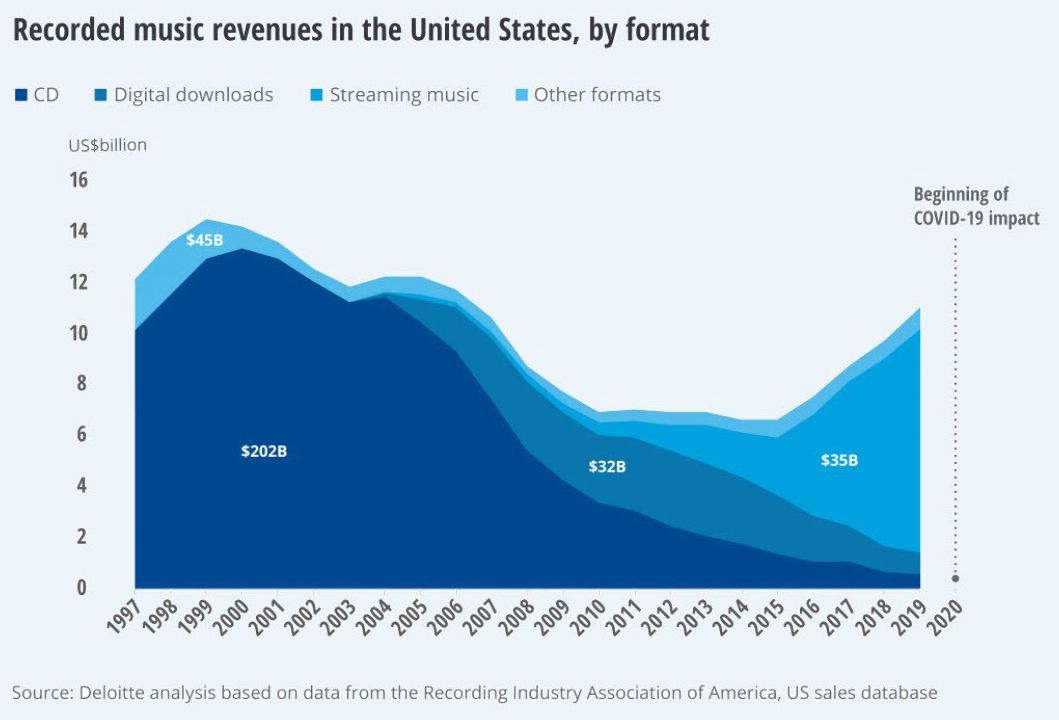

History, of course, had other plans. As the meeting progressed, Brandenberg quickly realized he wasn't pitching to a receptive audience, with RIAA reps explaining that the music industry did not believe in electronic distribution. Over the next decade, the DRM-free MP3 would eat the recorded music business alive: CD sales, which made up 95.5% of industry revenue, would decline from a peak of $18B in 2000 to just $7B in 2010.

While the RIAA's ill-fated decision is now common knowledge, the reasons behind it are not. Although no single factor drove the group to rebuff Brandenberg that summer – he was, for starters, barking up the wrong tree, as the RIAA was not the industry body to make sizable licensing investments in novel audio formats – another key driver would be a harbinger of things to come for the music business.

Central to the industry's refusal to engage was a far more subjective decision. The RIAA's advisory panel of engineers – those who take an initial rough mix and turn it into the sonically polished gold you eventually hear – insisted that MP3s just didn't sound as good as CDs. In the years since, multiple double-blind studies have proven there is no perceptible difference between high-quality MP3s and CDs, particularly for untrained listeners.

As Stephen Witt observes in his canonical history of the MP3, How Music Got Free, this decision wasn't just unwise: it was fundamentally misguided. The artists and engineers paneled by the RIAA didn't only misunderstand their customer – the listener, for whom convenience is king – but the very technology shifting the ground beneath their recording consoles.

The RIAA engineers were living 'below the API', making a momentous strategic decision in a world disrupted by technology – a world they no longer understood. This choice wouldn't just go down in the history books as an all-time blunder: it would catalyze a fundamental change in what it means to be a musician in our modern era.

In the 24 years since this fateful decision to spurn the MP3, the music business has been completely upended. CDs, a former industry goldmine, are now a comically obsolete format; streaming, conversely, has become the primary means of consumption for most music fans, transforming power structures, economics, and listening habits in one fell swoop.

While much has changed over this time period, much also remains the same. Many artists, based on my personal conversations, feel exasperated and lost in an industry that isn't just radically changing, but where the rate of transformation is accelerating each day. The story of the RIAA and the MP3 demonstrates how essential it is for creators to understand the technological changes occurring around them: not doing so can have monumental consequences.

Today's artists can similarly benefit from a deeper knowledge of the underlying mechanisms, principles, and systems determining the fate of their art. This knowledge doesn't mean it will be easy, or that every artist who wants to make a living off music will be able to do so, but it's a lot easier to play the game if you at least know the rules of the field.

The goal of Above The API is to take a deeper look at how our increasingly digital world functions, and what that means for our collective future. If you’re an artist, this is an in-depth guide to the world you operate in – how we got here, what it looks like today, and where we're heading. If you are, like me, building the next generation of creator platforms, it’s a call for all of us to build something better. Even if you have barely a passing interest in music, there’s something here for you as well; while the particulars of this story are about the record business, the underlying themes around the digitization and transformation of work are about nearly every business.

In part one of this two-part series, we'll examine the primary technological forces driving the exceptionally difficult economics of the modern music industry for artists: an explosion in supply versus demand, the surge in catalog content, pro-rata royalties, and increasingly extreme power law distributions on streaming platforms.

Breaking Music's Million Dollar Wall

At a high level, we can trace the music industry's staggering changes over the past 20 years back to two initially discrete technological trends which have, in recent years, become deeply intertwined in a relentless push to remake what it means to be an artist: the democratization of music creation, and on-demand streaming.

I've been a music person my entire life. Although I didn't play instruments growing up, I could recite, without error, the exact track length and tracklist of full albums well before I was ten. Several years later, as a high schooler in New York City, I was the person my classmates went to for mixes and Mini-Discs (my personal favorite of the industry's forays into planned obsolescence). Shortly thereafter, I began interning at Def Jam Records during the Lyor Cohen and Roc-A-Fella heyday of the early 2000s, at 16 years of age.

Reading this now, you likely have a question – why did I not try making music myself, given this deep interest? The answer: because it was largely not possible to do so. Over the past twenty years, however, technology has revolutionized music creation, with vast implications for the economics of being an artist.

Computing power, over time, moves from singular, centralized systems (a server occupying a full building at a university in the 1960s) to smaller, distributed devices (ubiquitous laptops and smartphones). In the 1980s, a well-to-do family might have had a single computational device for the entire household; today, nearly every individual in America (and increasingly, the world) has at least one, if not multiple devices. In 2020, there were approximately 30B internet-connected devices in the world: by 2025, according to SoftBank estimates, there may be one trillion.

This diffusion of compute, which began accelerating dramatically in the late 1990s with the advent of affordable and stylish networked computers, was the first crack in what I call music's million-dollar wall; the transition from a time of scarce production, performed in million-dollar recording studios by a select group of creators, to an era of near-limitless creation by anyone with a laptop.

In 1995, making music with computers was an exclusory process. Studio time was expensive, and attempting to build a semi-pro home studio including a PC would have required a budget of thousands of dollars just to get started. Studio time, in fact, was a secondary concern: why book a studio to produce music if the gear to write and practice on was so scarce in the first place? And so, in the mid and late 90s, as had been the case for decades, professional music creation remained behind the looking glass for all but a select few. That looking glass, as with so much else, would be utterly shattered by the computing revolution of the last two decades.

Today, millions of creators make music around the world at near-zero marginal cost. Image-Line, the creator of the legendary recording software FL Studio (which I would eventually start producing music on), says their application receives between 20,000-40,000 downloads per day (11M/yr) – and this figure, which I first noted years ago, has likely grown since. Logic Pro, a competing Digital Audio Workstation (DAW) acquired by Apple in 2002, persistently remains at the very top of Mac OS App Store paid app charts, while GarageBand, Apple's free-to-use DAW, claims the #1 spot on the free chart year after year. The music production software industry is currently a $3.2B/yr business, which is forecast to grow to $12.1B by 2027 – an eye-popping Compound Annual Growth Rate of 21.2%. Meanwhile, individual music production SaaS platforms, such as Splice, are approaching unicorn ($1B+) valuations, showing increasing market and investor demand for creator tools.

As we've learned over the past two decades, music creation is a process that naturally lends itself to relatively basic algorithmic engineering. I can now, as a producer, instantly access spot-on emulations of analog recording equipment – including boutique reverbs, equalizers, and compressors that cost upwards of $10,000 each – for under $100. It's also quite possible to make a record in a bedroom that sounds indistinguishable from one made in an elite recording facility 20 years ago. That 'million-dollar wall' is now mere dust on a studio floor.

Conversely, other sectors of entertainment – most notably the film industry – have not yet seen the same level of disruption from algorithms. Producing a summer blockbuster still very much requires an enormous budget, physical hardware, and expensive talent. While the film business may be grappling with streaming in its own ways, its elite creative class still firmly occupies rarified air. In time, this will change: AI and advanced graphics software will likely make it possible for home directors to create films that look like nine-figure epics, while top actors will license their IP to deepfake algorithms, enabling anyone with a budget to use their likeness. I suspect the industry will see a similar crumbling of norms and power structures in the process.

Unlimited Supply + Fixed Demand = 🤨

Just as making music has become radically more accessible, the past 20 years have seen the process of getting finished music in front of consumers equally disrupted by technology. In the pre-digital era, music distribution centered around sprawling supply chains involving the manufacture, shipping, and sale of physical goods (CDs) to thousands of retail outlets – a complex job designed to enforce the hegemony of the 'Big Six' (now Big Three) major labels.

As with so many other verticals, this arrangement wasn't long for the world of zeroes and ones, with a cost of production that would drop to near zero once compact discs became code. Companies such as DistroKid now offer artists all-you-can-eat distribution to streaming platforms for just $19.99 per year, radically changing the calculus for artists: why put out one song, when you can put out a dozen and flood the market?

The democratization of music creation and distribution – which, as we will explore in part two of this piece, is just beginning – has produced what is, in hindsight, a very obvious outcome: the supply of music to listen to is utterly exploding. In 2000, roughly 1.5 million songs came to market each year: currently, over 60,000 songs are released each day (22M/yr). Most importantly, this growth has not been linear: 20,000 songs were released daily in 2018, representing a 3x in just three years.

This Cambrian explosion in music creation is in many ways a wonderful thing, and I'm not here to criticize it: I made a brief career as a producer thanks to this very phenomenon. There is, however, a major problem with rapidly expanding supply in any economic system: if demand doesn't keep pace, suppliers can't maintain the value of their goods, particularly if they lack the ability to experiment with differentiated pricing due to intermediation by middlemen. In part two of this piece, we'll explore this issue in far greater detail.

While precise statistics on time spent listening to music in the pre-streaming era are scarce, I firmly believe that while controlling for population growth, demand for music has increased only modestly over the past twenty years, and certainly not at the ~20X+ pace of supply.

In 2000, as Napster began devouring the recorded music business, network administrators at colleges noticed that MP3 downloads were consuming up to 61% of their bandwidth – demonstrating a voracious appetite for music long before the streaming era. Industry revenues, when computed across the U.S. population, paint an even more stark picture. Average U.S. consumer spending on recorded music peaked at ~$80 per year in the late '90s, while the average music consumer spent less than $15 per year on streaming as of 2017. While technology has radically changed circumstances for creators, biology has kept them precisely the same for consumers: we still only have 24 hours a day and one pair of ears with which to listen.

Although streaming user numbers have unquestionably grown in the last decade, it is imperative to bear in mind that these do not inherently represent net new sets of ears (demand) to soak up the explosion in supply. In many cases, the music industry is merely persuading consumers that music does, in fact, have some marginal value after it became free in the early 2000s.

As if music's internal competition – the torrent of supply entering the marketplace, jockeying for a relatively fixed set of eardrums – weren't enough, the proliferation and evolution of highly engaging media formats, namely video games, presents a serious threat to music's share of time in the attention economy. Together, these forces are combining to simultaneously make it easier to make music – but harder to make a living making music – than ever before.

Concurrently, the economics – and, counterintuitively – the scale of streaming are decimating music's 99%.

Hype Doesn't Pay The Rent

Over the past decade, the corporations atop the industry once left for dead during the doldrums of piracy have returned with a vengeance. Universal Music Group, the leader in global market share for recorded music, holds a market capitalization of $49B after a wildly successful IPO in Q3 2021. Hipgnosis Songs, a trailblazing and controversial fund investing in publishing catalogs, has, in the course of just three years, acquired a catalog of songwriter royalties valued at $2.2B, while a recent $1B infusion from private equity leader Blackstone Group ($649B AUM) signals music's bull market may be in its early innings. Music's boom also extends to the platforms leading the industry's top-line revival: Spotify S.A., the Swedish company that has become interchangeable with streaming itself, currently has a market cap of $52B after just three years in the public markets.

If only this rising tide were lifting all boats. While Goldman Sachs analysts revel at the industry's 'massive revival' thanks to streaming, the economics of being an artist – even an artist doing relatively well – are getting more desperate with each passing day.

How is it possible that corporations can be accruing hundreds of billions of dollars in value while artists, producers, and songwriters face a more bleak outlook than ever? The bifurcation of music's fortunes can be attributed to three primary factors: the rise of back catalog content, pro-rata royalty models, and the power law distributions of streaming aggregators.

A Surge In Catalog

In truth, the utter flood of music entering the marketplace discussed earlier is only half of the 'supply side' story of the streaming era: it is equally vital to understand how a mass of back-catalog content (often referred to as 'catalog') is stacking the deck against the sea of musicians releasing music in 2021 and beyond.

While the growth of streaming as a whole over the past decade is staggering, the share of catalog music consumption is perhaps even more remarkable. In 1H 2021, the category drove 66.4% of all streaming in the U.S. – up from 63.9% in 2020, and 60.8% in 2018. Catalog is technically defined as any music released over 18 months before a listener pressed play – meaning two-thirds of all streams now occur on music at least a year and a half old.

Although catalog share expansion may seem inevitable – after all, as time progresses, a higher volume of music is technically older than 18 months – recall that the quantity of new music releases has grown 3x from 2018 to 2021, indicating that the supply of new music is outpacing the growth of catalog. Growth in the latter's share of streams is not merely inevitable, but rather a sign of demonstrated consumer intent and algorithmically driven listening.

As I've argued recently, our modern attention economy is a zero-sum game – time spent consuming one piece of media inherently creates a scarcity of time to consume the rest of the world's content. The rise of catalog on major streaming services is, to be clear, not merely an anecdote or interesting statistic: it is a primary reason why many artists releasing new music today struggle to find an audience for their work. My aim is not to vilify catalog or imply that new releases are inherently more deserving of streams than older songs – I am an advocate for all artists. Catalog's grip on streaming consumption, however, undeniably contributes to the scarcity of attention and demand that awaits a deluge of supply, presenting formidable challenges for the next generation of musicians.

The Median Cannot Hold

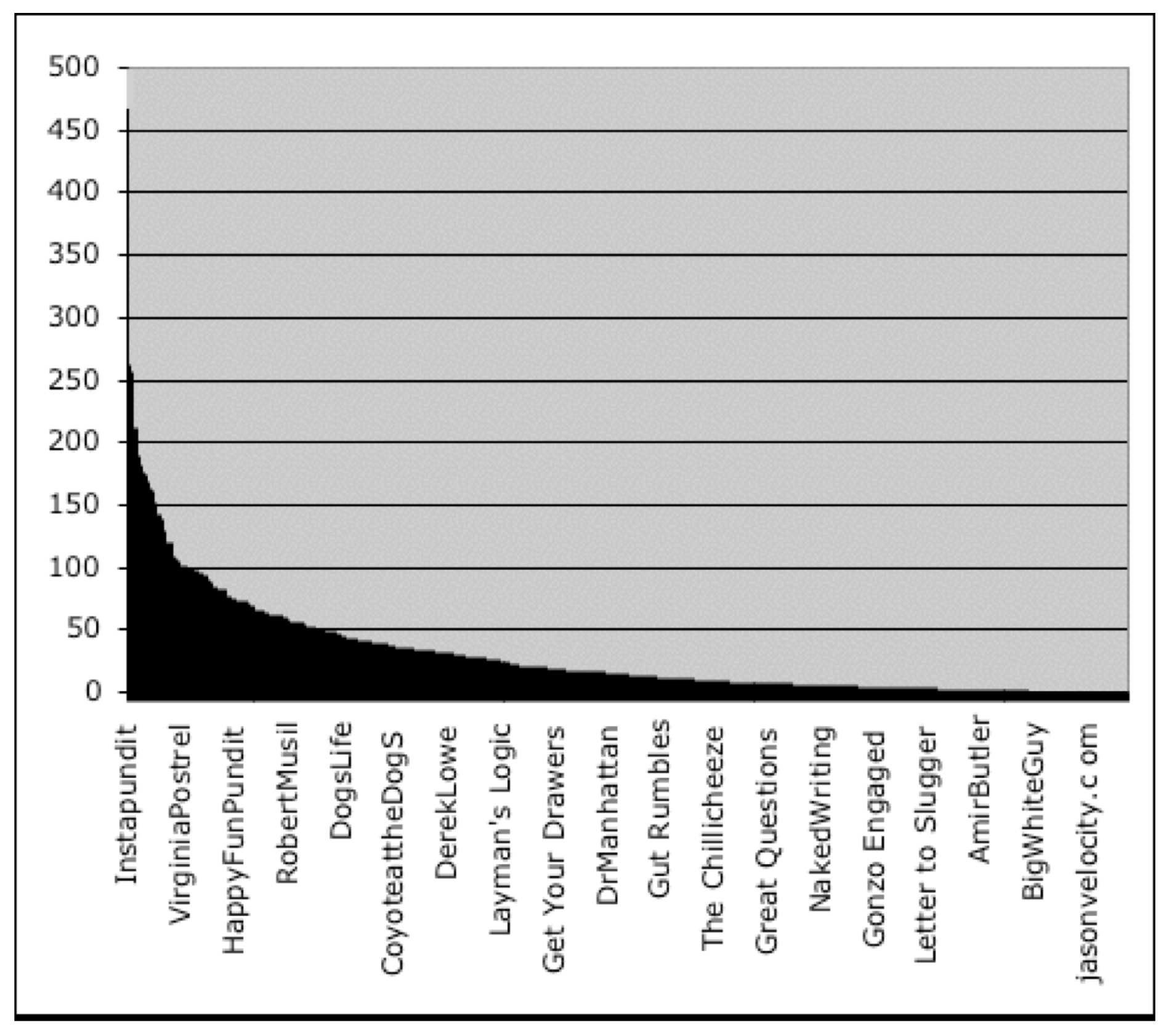

The second factor driving progressively bleaker prospects for artists is a phenomenon which appeared early in the internet's history, and which has since re-emerged on nearly every digital platform at scale: power law distributions.

Just as Napster began to eat the music business in the early Web 2.0 period, American writer Clay Shirky penned what would be among the most prescient analyses of our digital age. As web blogs exploded in popularity around the turn of the millennium, Shirky observed a peculiar phenomenon (emphasis mine):

Power law distributions existed long before they emerged in digital aggregators and systems: Shirky was, however, among the first to note how powerful this effect would likely be on the digital economy in the 21st century. Shirky observed that the traffic volume to web-based blogs was grossly weighted towards the few at the very top of the dataset: an elite handful of authors received more traffic than the entire long tail of writers. Of 433 listed blogs, the top two accounted for 5% of inbound links; the top 12 for 20%; and the top 50 blogs – under 12% of the overall group – received 50% of links.

Crucially, Shirky also observed that as the number of options in a system rose – such as more artists on a streaming platform, or authors publishing blogs – the curve of top-heavy distribution counterintuitively becomes more extreme, not less. In other words, as options increase, the massive gulf between the haves and the have nots widens, not narrows.

Written in 2003, nearly twenty years before our current apex of musical production, Shirky's words are remarkably prescient.

More accurate words to describe the music industry in 2021 do not exist. Consider the following:

- Between 2014 and 2020, the top 0.1% of most popular tracks accounted for more than 40% of all streams, while the top 0.4% accounted for more than 65% of streams from 2016 onwards.

- The top 1% of tracks accounted for 75-80% of total streams; the top 10 percent for 95-97%.

- The top 1% of artists account for 78-80% of streams; the top 10% for 98% of streams. The top 0.1% of artists drive 39-43% of all streams.

- 90% of streams on Spotify are shared between just 43,000 artists.

- Approximately 20% of Spotify's catalog has not been listened to even once.

- The top 10,000 Spotify playlists account for 93% of total playlist follows.

There are two important notes at this point. First, as Shirky notes, creators of digital systems need not try to create these power law distributions, and their existence does not inherently mean that platform builders are evil, greedy, or trying to sabotage the long tail of creators – they are merely endemic. Second, as we will discuss in part two of this piece, these statistics are remarkable due to the difficulty that music creation still intrinsically entails. Over the coming decade(s), music creation will become radically more democratized and accessible, scaling beyond trained creators to those with little musical knowledge via AI and Machine Learning. If you think we're in a period of over-supply now, I suspect you haven't seen the half of it.

The Lion's Share

If the balance of attention in the streaming era seems just a bit out of sorts to you, I've got another surprise: the economic model is even worse. Streaming has brought about the widespread implementation of a revenue and accounting system that only skews things further against the long tail of creators: the pro-rata model.

Consider the following scenario. Let's assume you pay $10 per month for your streaming music subscription, and on said service, you only listen to two artists you love. You might assume that your subscription fee is split evenly between those two artists/groups (or their labels), with some remainder going to the platform itself – a reasonable assumption.

Unfortunately, it doesn't quite work that way. In fact, it doesn't work that way at all. Rather, a pool of revenue is created each month – a pool of every user's subscription fees and/or advertising revenue – which is then divided according to each artist's share of streams in that period.

At first, it might not be obvious why this is so problematic for most creators, so let's revisit our example: instead of your two favorite artists each getting half of your subscription fee (minus the platform's take), your money simply flows into the revenue pool, and all artists are paid out according to their share of total plays on the platform. In other words, your money doesn't mainly go to your two favorite artists – but rather tiny fractions of a cent go to every single act on the platform, relative to their share of total streams.

One need not be a mathematical genius (I'm not!) to see that this system grossly disadvantages the average artist – who, as we have already established, is likely seeing an infinitesimally small fraction of overall streaming volume. While the pro-rata model devalues all but the top 1%, it simultaneously creates a bizarre disconnect between fans and artists regardless of one's size. At its core, pro-rata detaches the listener from the content producers they listen to, abstracting what should be a direct monetization system for one based on opaque formulas and open to manipulation.

Oh, and manipulate it people do. The pro-rata model has created perverse incentives in our current streaming ecosystem, leading to bad actors outright gaming the system and depriving legitimate artists of their share of revenue (which, I should note, is likely to be tragically small already):

Today I want to talk about one of the craziest stories to happen in music this year - how a "sleep sounds" label has exploited loopholes in streaming, using thousands of 31 second songs to become a top artist on Spotify w/ 10M+ daily streams.

— Dave Edwards 🎧 (daveedwards.eth) (@itsDaveEdwards) September 24, 2021

This is a wild one, buckle up 👇🏻🧵

In perhaps the first bit of good news in this article (sorry it's a bit dark!), there isn't just widespread discussion in music on the unfairness of pro-rata: some platforms are taking action. Beginning in 2021, SoundCloud implemented a per-user revenue model for artists distributing music through their platform; similarly, Deezer is experimenting with a user-centric revenue system across seven million subscribers in 180 countries. More changes are coming.

While replacing the pro-rata model will help most creators, it will not fix the horrid economics of our current time. Although our industry has survived, with streaming just narrowly snatching it from the jaws of piracy, the fundamental devaluation of music perpetuated by the Napster era remains with us to this day, corrosively devouring our creative class and their ability to make a fair living.

Trying to Make a Dollar Out of 15 Cents

As we've now established, multiple factors are converging to make the business of being a musician tougher than ever before. But what exactly do those economics look like – how much do artists earn from streaming in 2021?

Rolling Stone's Tim Ingham – who consistently produces some of the most thorough and sobering looks at the music business – published an excellent piece last year on this very topic. As Ingham notes, it's possible to reverse engineer Spotify's quarterly earnings releases and their internal statistics to arrive at some ballpark estimates of creator earnings. For brevity, I will condense Ingham's math into bullet points here, but I highly recommend you read his full breakdown.

- Spotify Q2 2020 topline revenue: $2.05B

- 52% of topline (royalties) paid to rightsholders: $1.07B

- 43K artists earn 90% of royalties. 90% of 1.07B = $963M

- 43,000 making $963M = $22.39K per artist per quarter

- $22.39K/quarter paid to rightsholder = ~90K/year

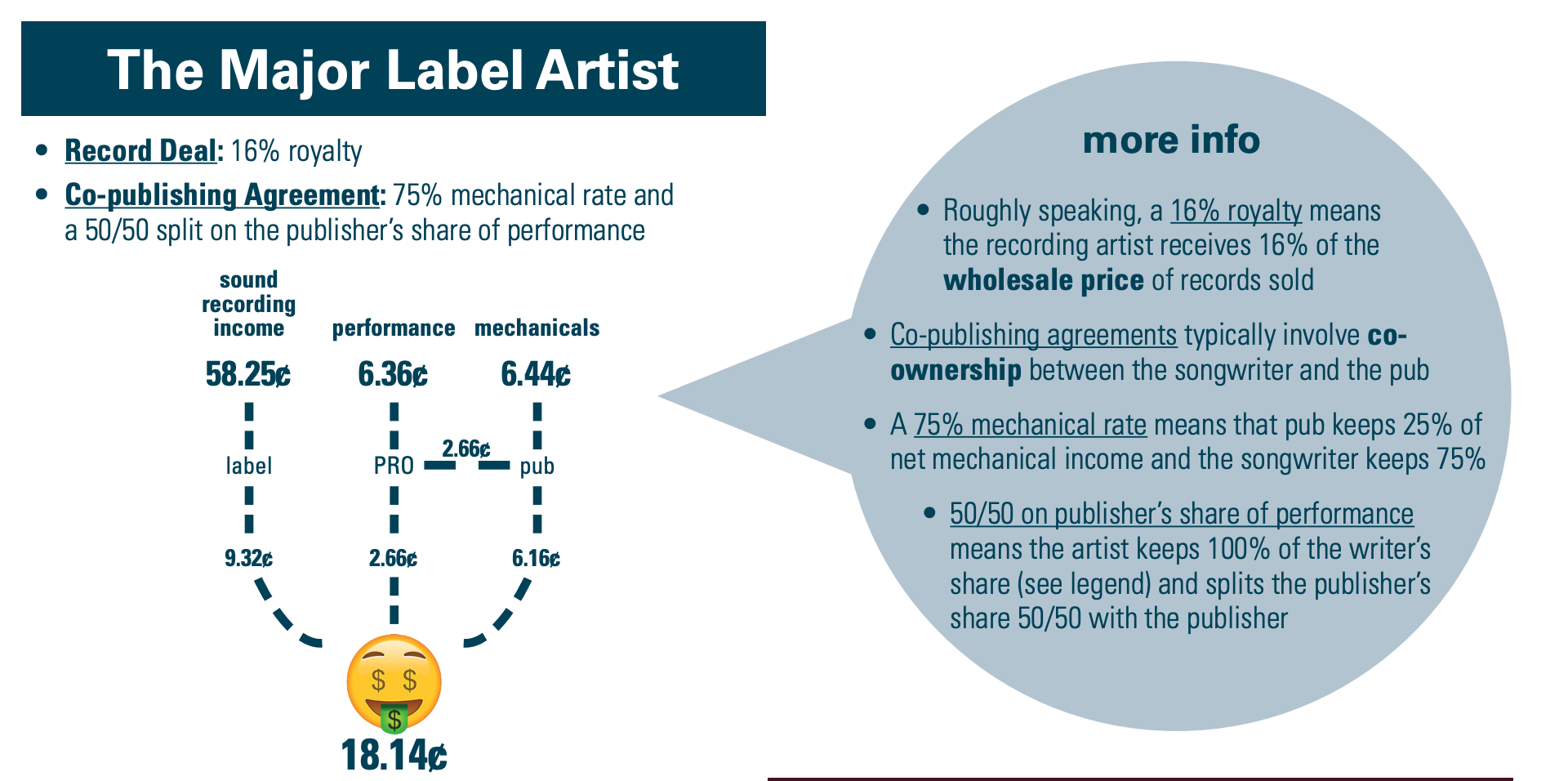

Let's dive into these numbers a bit deeper. The first crucial thing you need to understand about that $90K/year number is that it is usually not what the artist earns: it is what their label earns for their catalog, unless the artist is completely self-distributed via a service like DistroKid, where they keep 100% of royalties. With royalty rates for artists on major labels averaging 15-25%, $90,000 gross quickly becomes $22,500 per year (at 25% rate – the high end). It should be noted that independent success stories at this level are few and far between; the top 0.1% tier of songs contain nine times as many tracks owned by majors as those owned by indies or solo artists.

This royalty rate is effectively a revenue split, where the creator keeps some percentage of total royalties – a split that only kicks in once the label has fully recouped the artist 'advance', an interest-free loan given before a project is delivered. An artist on an indie label, where a revenue split is more typically 50/50, would keep roughly $45K pre-tax.

Further, as we've already established, power law distributions don't simply mean that those at the top do far better than the long tail; even within the top 10%, earnings are likewise stratified, with those at the very apex taking home the lion's share of the revenue. This means that even within this elite group of 43,000 artists who take home 90% of all royalties, revenue is heavily skewed towards the ultra-top earners. This distorts the average, making it look as if more creators are 'doing ok' than is actually the case.

As Ingham goes on to note, these numbers are alarming of their own accord: they're doubly so when we consider that these are the lucky artists – the 43K (out of millions on Spotify) earning 90% of all royalties. What do things look like for the less fortunate in music's long tail?

It's hard to fathom, but this math gets even worse: Ingham assumes that this pool of scraps is divided between only 2.96M artists (a number from 2018), while more recent figures put the number closer to 8 million. If those more recent numbers are correct – which Spotify's own investor presentations suggest – the average long tail artist on Spotify earns roughly $13 per quarter.

Ingham's numbers here line up with myriad of ancillary data from reputable sources – these aren't outliers or skewed estimates. A recent landmark study from the U.K. government's Intellectual Property Office found similar levels of compensation for musicians;

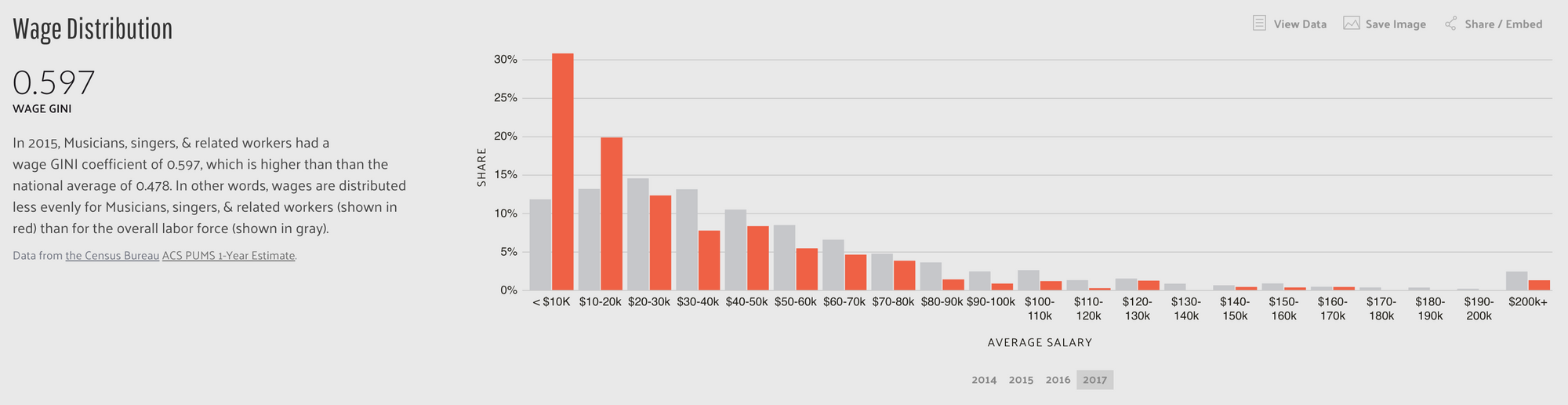

U.S. Bureau of Labor statistics tell a similar story, with only 1550 independent artists, writers, and performers employed as of 2020. Census Bureau data compiled by DataUSA shows a highly similar income distribution for musicians in 2017:

In 2021, outcry over streaming's horrid economics led Spotify to take the highly unusual step of launching a full-scale PR campaign and dedicated mini-site, Loud & Clear, to counter the prevailing narrative. The aim of the initiative, to use its own words, is to reassure creators that the company "hears you, loud and clear." Despite its stated goal, Loud & Clear often avoids giving detailed numbers on creator earnings, opting instead for broad statements about how 'more artists' are making money on Spotify each year – a fact which I would hope is true of any growing platform.

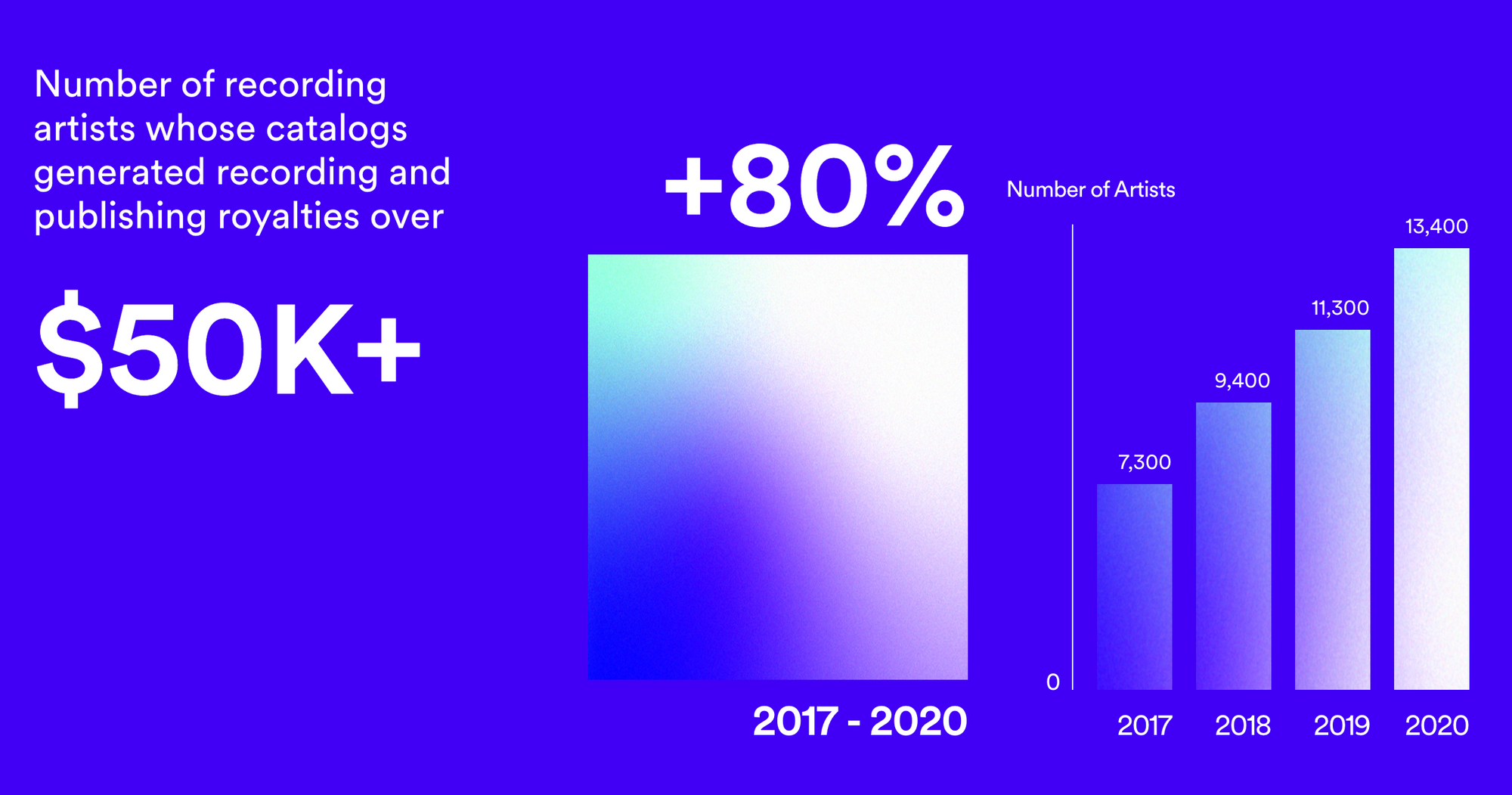

Where it does provide specific figures, Loud & Clear also strategically utilizes our natural misunderstanding of relative versus absolute values, using the latter to imply the former – the percentage of artists doing better – is also improving, when it often is not. Consider the following example, where a chart is used to claim that 80% more artists now make $50K+ on Spotify per year than four years ago:

- In 2017, just 7300 artists hit this threshold, out of roughly 3M (a number pulled from Spotify's own SEC registration statement).

- This elite group equals .0024 of the total artists on the platform.

- In 2020, 13,400 artists hit the threshold.

- Sounds better, until you consider the number of total artists simultaneously grew to over 8M.

- 13,400 of 8M = .0016

- While the absolute number of total artists above the $50K threshold increased, the proportion of total artists on the platform doing so shrank by 33%

A good rule of thumb in life: anytime someone tries to sell you on something with a numerator, be sure to ask for the denominator as well.

A Symphony for One Man Alone

In reality, however, there's an even larger power law distribution at play, one that makes even superstar artists look like paupers in comparison: the wealth accruing to Spotify CEO and founder Daniel Ek. In researching this piece, I wanted to better understand how Ek's personal earnings compare to those of the eight million creators using his platform – and what I found, which I do not believe has been published elsewhere, is astounding.

While a quick Google search will tell you Ek's net worth is ~$4B, this number seems pulled out of thin air. After not being able to find a source for the oft-quoted figure on roughly a dozen websites claiming it as fact, I decided to dig a bit deeper with the help of SEC filings, as Spotify has been a public company in the U.S. since 2018. There, in Ek's 2020 13G filing, I discovered that he held over 32.7M shares (17.2% of total outstanding float) at the end of 2020, roughly double most estimates published online.

Ek owns just over half of these shares in his own name, while the remaining 15.3M are owned by a Cyprus-based company he is the only shareholder of, D.G.E. Holding Ltd. Although the SEC (accurately) considers this to be a singular person holding the aggregate shares, I believe this structure is what throws off so many automated websites which have tried to estimate his stake in the past.

But the truly surprising statistic here, and the one most relevant to our discussion, emerges when comparing the paper gains Ek's shares enjoyed in 2020 versus total royalties paid to rights-holders. In 2020, Spotify stock started the year at $151/share and finished at $314/share; the value of Ek's stake jumped from $4.93B to an eye-popping $10.27B, a difference of $5.34B.

This is where things got interesting, as that 'difference of $5 billion' figure rang a bell in my head. Where had I heard a similar number recently? It turns out that, as part of Spotify's efforts to calm concerns over royalties, the company announced it paid out $5B to the music industry in 2020. There it was.

Put more simply: in 2020, Daniel Ek appears to have accrued as much (or slightly more) in stock appreciation than Spotify paid to all rightsholders in the same year. You read that correctly – he seemingly gained more in share value than all eight million artists on Spotify (and their labels, distributors, publishers, and PRO's) earned, combined.

I want to pause here to explain my motivations in discussing Ek's stake in his company. I don't begrudge anyone for attaining wealth, so long as it's earned honestly. I know firsthand how difficult it is to build a startup, much less one in the music business, and have no issue with a founder who starts a once-in-a-generation company doing exceedingly well. Startups are a vital part of our economy that reward employees for creating incredible products, and Ek and his team have built a truly amazing streaming experience for consumers. The problem, however, is not the consumer-facing part of the platform: rather, it is how the company treats those who provide it with content.

What makes this statistic all the more disturbing are two additional factors: the year in which it occurred, and what actions Spotify has taken since to rectify it. 2020 was likely the worst year in modern history for musicians, nearly all of whom saw their main source of earnings – touring – utterly decimated by the COVID-19 pandemic. Second, Spotify has, to my knowledge, not taken any material steps to remedy this situation in 2021. The company continues to push for lower royalty rates to musicians and songwriters; has given zero stock to the artists who supply their platform; and, most alarmingly, recently announced a plan to use $1 billion in excess cash to repurchase shares of their common stock, which only creates value for existing shareholders.

Spotify's share repurchase plan is the part of this story that particularly upsets me as an advocate for artists. Over the years, the company has frequently pushed back on outrage from the creator community over streaming payouts by arguing that the problem is in fact not Spotify itself, but the entrenched industry power structures that siphon money from artists in the royalty payment pipeline. To hear the company tell it, they're already paying out every penny they can to creators; any issues we still have with streaming economics should be directed to major labels, PRO's, and publishers. While there is some truth to this, and the industry royalty pipeline could certainly use reform, this is far from the only issue. Futher, the share repurchase plan exposes this argument as the facile statement it is. A platform built off the hard work of creators is choosing to enrich current shareholders – to the tune of one billion dollars in excess cash – instead of helping artists become stakeholders themselves.

I also want to caution those in music reading this against the most frequent reaction to discussions of Spotify's inequity, which often posits that the solution is simply a better platform to replace it. To be clear, there is a staggering amount of innovation happening in music streaming and ownership, and I am deeply excited for a better ecosystem to emerge in the next five to ten years. But merely putting our hopes in a new platform is letting Spotify off the hook; in Q3 2021, the company had 381 million Monthly Active Users, which means it will take years for a competitor to disrupt them at scale. In the meantime, unless Ek changes his priorities, artists will continue their existing race to the bottom (which we'll discuss in depth in part two of this series) while Spotify's large shareholders reap more value than ever. New and better platforms are indeed the long-term solution; in the short-term, however, change at Spotify itself is needed for better outcomes for creators.

As I noted during our earlier discussion of power law distributions, I don't believe Ek's original intent when starting Spotify was to massively extract value from creators. Rather, I believe the platform initially fell victim to its own success: in network-based digital systems which scale to near infinity, problematic second-order effects can reach escape velocity just as soon as they first become apparent. This isn't to let Ek off the hook either: organizing billion-dollar share buybacks in the midst of the current discussion over royalties is tone-deaf, to say the least. Far from hearing his suppliers 'Loud & Clear', Ek appears ever more detached from the reality his platform has created for artists.

This is a theme which we'll return to often on Above The API: what responsibility do founders hold when it becomes apparent that their creations are negatively impacting a large group of people? I don't have a universal answer for that, nor do I have a quick fix for Spotify's situation and that of music streaming at large – but I do know we need to try. Platforms must invest in more robust monetization features for creators that allow a larger swath of artists to be discovered and subsequently paid fairly for their work. In part two of this piece, we'll discuss some of these potential solutions in far more detail.

This income disparity in the arts is a central reason why I often internally cringe when people extol the 'creator economy'. Better platforms may well be on the way soon, but the economy I’ve been creating in as a musician for the last decade is little more than a fiefdom.

Closing Thoughts

As we enter the second decade of the streaming era, musicians are caught in a catch-22: it's easier to make music than ever before, while simultaneously being harder than ever to make a living doing so. Although I hope to have added something to our collective knowledge of music's evolution in this piece, I'm also keenly aware this isn't exactly news. For years, the dim financial reality of streaming has been a foregone conclusion for many artists, with most considering the medium as supplementary income (at best) for touring, merch sales, and other revenue streams.

In the wake of the COVID-19 pandemic, however, I no longer believe this is tenable. Touring has been exposed as the precarious endeavor that it truly is – a wonderful (and lucrative) means of connecting with fans, but one exceptionally prone to disruption by events beyond any of our control. Streaming – the same consumption channel driving hundreds of billions in value for corporations – can no longer be sold to artists as a 'side hustle' or incremental income. If streaming is the primary means of interacting with music – which it is – it must also become the primary driver of making a career as a musician for a wider swath of artists.

In part two of this series, we'll take a very deep dive into the mechanics of streaming aggregators, consider likely changes to music's supply and demand dynamic in the next decade, and, perhaps most importantly, consider tangible solutions that can create a better industry for the next generation of artists.

-Dave Edwards

Above The API is a free monthly newsletter covering music, technology, and startup culture. If you made it this far, I hope you'll consider sharing and subscribing – it's completely free!

You can find my Reading List – articles, books, podcasts, and cool stuff to check out – for this issue of Above The API at: https://www.daveedwards.co/reading-list/