It's been a lively start to the year in both music and video streaming. Just over one month in, we've already witnessed the emergence of several major trends that are likely to be with us for quite some time.

On the heels of a pivot to audio, Spotify now finds itself embroiled in a headline-grabbing conflict between its two primary creator cohorts: musicians and podcasters. As I'll explain here, there's good reason to believe this will not be the company's last.

Netflix, the dominant aggregator in an adjacent vertical, is no stranger to key-creator controversies. What ails the company now, however, may be far more substantive: after creating a booming market for IP acquisition, the world's leading video service is demonstrating just how precarious the zero-sum game of content ownership can be.

As it turns out, the story of these two companies – and their current troubles – is far more intertwined than many suspect.

Neil Young vs. Spotify

Joe Rogan all day, all night

In the third chapter of my deep dive on the modern music industry, Streaming's Endgame, I spent considerable time discussing the monumental shift occurring with Spotify's pivot to aggregate the world's audio. The transition, which began in earnest with the combined $404M acquisitions of Gimlet, Anchor, and Parcast in 2019, has now created the most significant negative PR cycle for the company since its public spat with Taylor Swift seven years ago.

By the time you're reading this, you've likely heard the particulars of the story – but here's a quick summary just in case.

Last week, famed musician Neil Young began a very public spat with the world's largest music streamer over its support for podcast host Joe Rogan. Specifically, Young was upset over Rogan (and the service by extension) providing a platform for COVID-19 vaccine misinformation via his Spotify-exclusive podcast, The Joe Rogan Experience. Young gave the platform an ultimatum: do something about it or remove my music. Spotify didn't hesitate to make an example of Young; the company promptly removed all of his music just two days after his initial demands were published. On Friday, Joni Mitchell announced she would follow Young's lead. On Saturday, Brené Brown, a podcaster with an exclusive Spotify deal, said she would pause any future podcast releases until further notice. On Sunday, Nils Lofgren announced he was joining Young and Mitchell in boycotting the platform. Later that day, Ek and Spotify at last broke their silence – with a vague statement that didn't mention Rogan by name – and received a tepid response (to put it mildly) on social media.

What can we glean from this still-developing controversy?

Audio Has Won.

In Streaming's Endgame part three, I made the case that Spotify's pivot to 'audio' signals a new era in the platform's vaunted history. This shift is not merely about adding ancillary content to an existing library of 70 million recordings: it is a long-term strategic realignment which seeks to replace loss-leading music with royalty-free long-form audio and concurrently redefine the very core of Spotify's mission.

This change, however, comes with a price. Given the zero-sum nature of consumption, the company cannot keep both creator cohorts happy: one will inherently receive more attention, financial investment, and marketing support than the other. As I argued at the time, the winner of this duel appeared quite clear: the platform is rapidly becoming an audio aggregator, not one built around music streaming.

There are myriad reasons why the company is backing Rogan over Young, several of which we'll dive into shortly. The most fundamental, however, is also the most important: Spotify is sending a clear signal to creators about who calls the shots going forward. As I've noted previously, this is no coincidence – while the company enjoys unmatched power over musicians and their livelihoods, it holds next to none over content creators of other kinds.

For a platform which didn't even support podcasts until 2015, nearly a decade after its launch, this is a truly remarkable fracture.

What if The Weeknd Did It?

One of the hottest discussions within the music biz last week revolved around one specific aspect of the Rogan controversy: the musician who catalyzed it. Many asked if a modern-day superstar – such as The Weeknd or Taylor Swift – would produce a different outcome with an identical set of demands.

First, let's contextualize Young and Mitchell both historically and statistically. Young was ranked #34 on Rolling Stone's list of 100 Greatest Musical Artists (ahead of John Lennon, Madonna, and Michael Jackson), has 21 Gold/Platinum singles and albums, and is the seventh most celebrated popular musician of all time according to Acclaimed Music. Mitchell is considered one of, if not the, most important female songwriter of the last century, and is a fellow Rock and Roll Hall of Fame member, with millions of records sold.

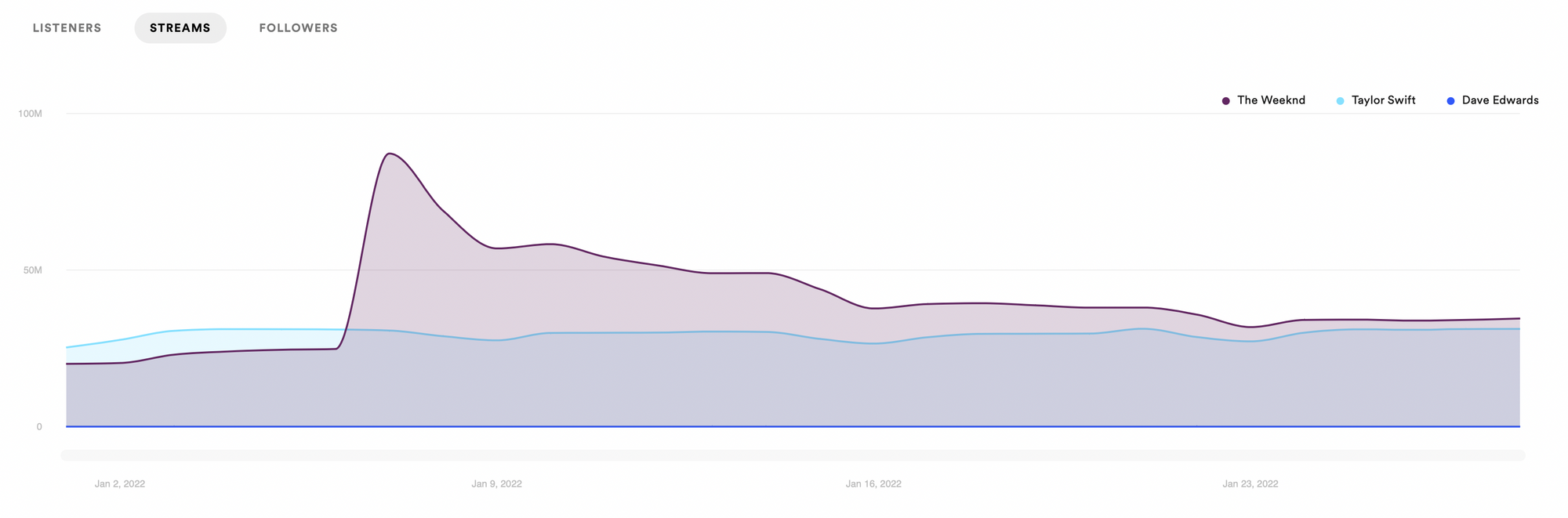

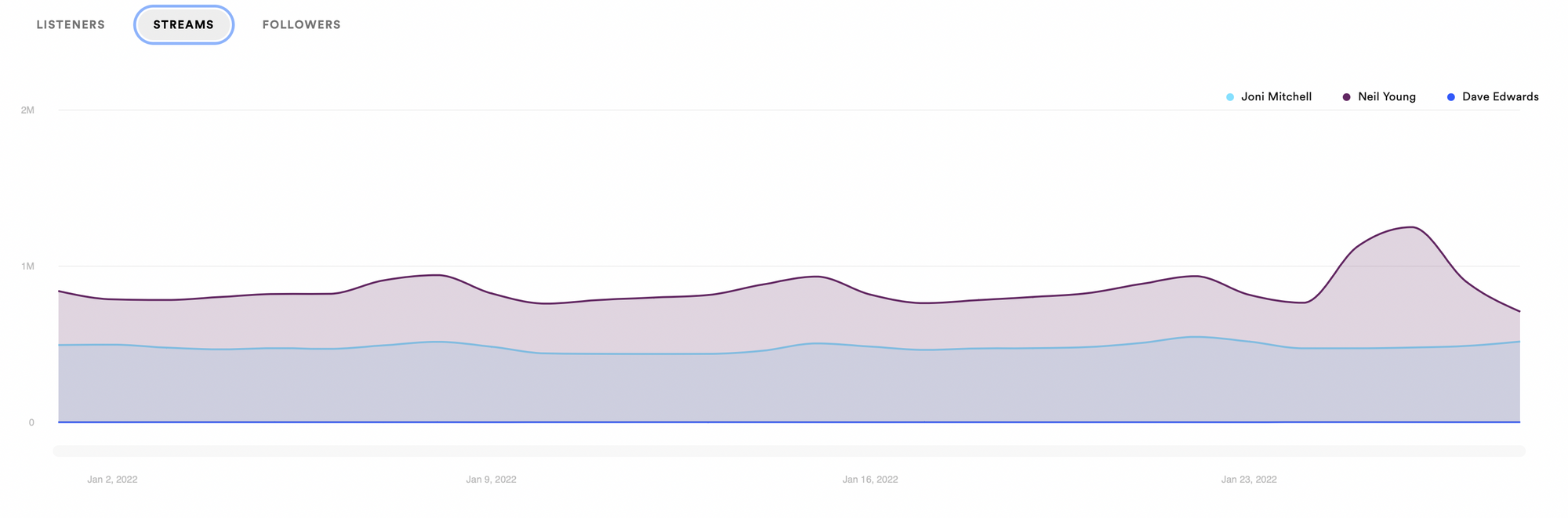

The key phrase in that last paragraph, though, is 'last century'. According to Spotify for Artists, Young was averaging around 1M streams per day before removing his content from the platform; Mitchell averaged ~500K. While these numbers are undoubtedly impressive (especially when comparing to my paltry totals, as you see below), they pale in comparison to modern-day superstars such as The Weeknd and Swift: the former was averaging ~50M streams per day following his recent album release.

The engagement delta between superstars of the prior century and our current one, then, begs an obvious question: what happens if a musician from the latter group follows suit? I believe this is unlikely, due to Spotify's unmatched dominance as the über-aggregator for music. Such are the soft-power luxuries of true aggregators, who command fear among their suppliers without needing to lift a finger.

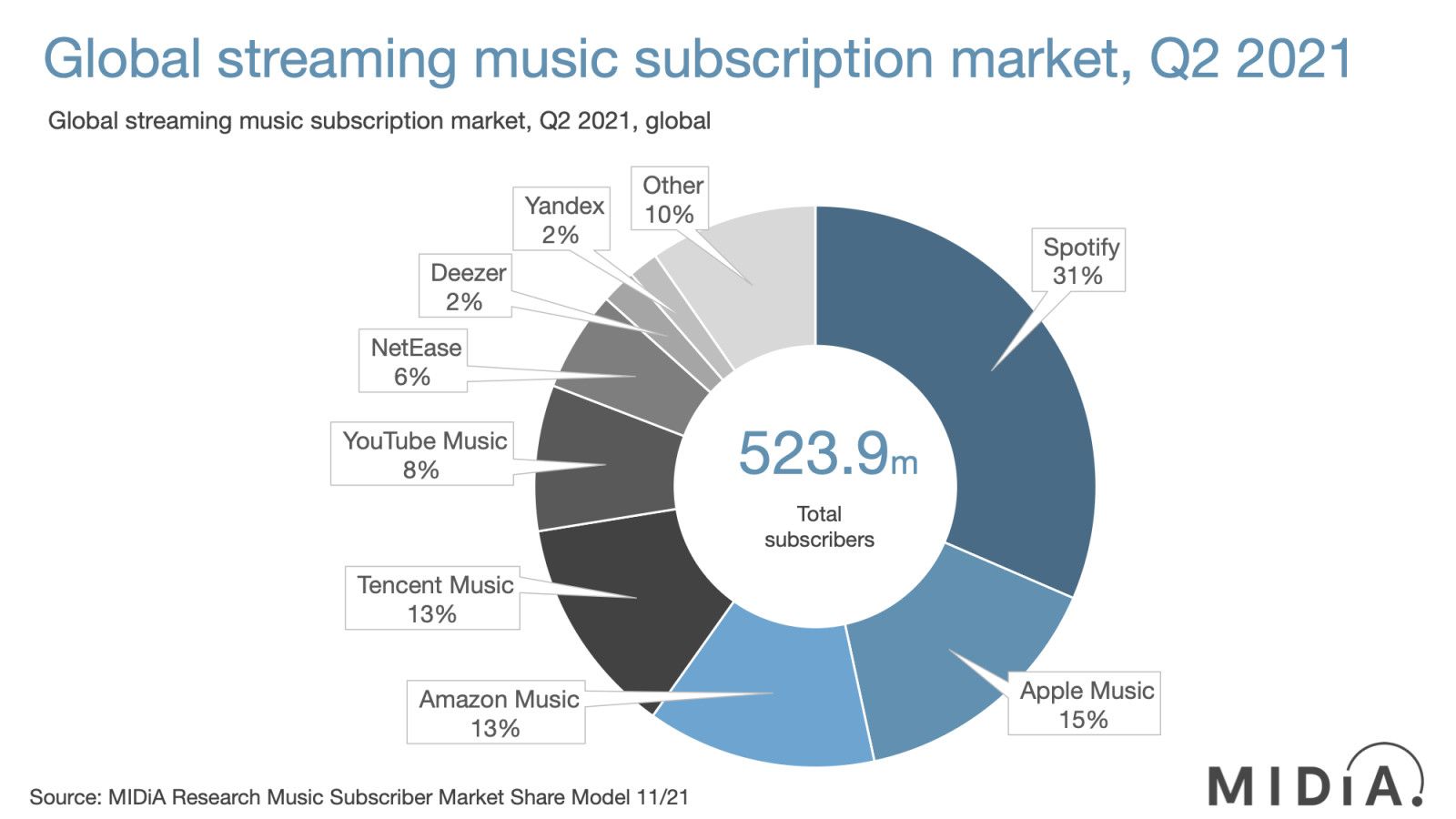

As I noted in December, Swift's on-again, off-again disputes with Daniel Ek's streaming behemoth provide an instructive case here. In 2014, challenging Spotify was a doable, if daunting, possibility for a superstar musician; doing the same in 2022 would be utterly devastating. What changed in the intervening period? In short, Spotify went from being the cool new app hoping to turn around the music business (industry revenues reached a nadir at just this time) to the backbone of the vertical itself, with a whopping 32% market share of global streaming subscriptions.

Tellingly, Swift last acquiesced to the platform's terms in June 2017 – when it had just one-third of the Monthly Active Users it currently enjoys – demonstrating the power of aggregators at scale. Apple's treatment of rockstar developer Epic Games (publisher of global smash Fortnite) offers a similar cautionary tale; in the land of digital super-scalers, even profoundly successful creators possess minimal power individually.

One rather interesting potential scenario again revolves around Swift: could she view this as the moment to exact revenge on Ek and Spotify for failing to improve monetization for artists after her previous protests of the last decade? While many are indeed speculating on the possibility, such a move would be far more complex than most anticipate, due to the well-publicized battle between the superstar and her former recording label, Big Machine Records. It's imperative to bear in mind that this conflict revolves around Swift's master recordings – the very song files provided to streaming services such as Spotify – which the singer does not control. Were Swift to remove her recent re-releases of Fearless and Red (projects designed to subvert the financial value of her older masters), Spotify would likely still keep her entire back catalog. This potential scenario differs greatly from that of Young, who was able to obtain his label's blessing to remove all of his recordings from the service.

Short of an alliance of modern-day superstars boycotting the platform in unison, however, I doubt any single creator at the apex of their career will stick their neck out over this issue – and they shouldn't be judged for that choice. Quite a bit of discussion online this weekend posited how easy it would be for Swift or another megastar to confront Ek and force Spotify's hand: I find this view misguided and problematic. Whether it's Taylor Swift or an emerging artist with far less fans, the onus is not on the artist – who is already underpaid and under-appreciated for their cultural value in the streaming era – to give up a primary, if insufficient, source of income.

What would it take to produce a different outcome? I believe there are only two groups of individuals who can realistically change the company's stance: its subscribers and employees.

The former, of course, is rather obvious: it becomes awfully hard to run a massive public company – which is forced to publish updated numbers every quarter, unlike a private corporation – if paid users begin leaving in droves. As I noted in my discussion of Spotify's Discovery Mode in Streaming's Endgame, users are the ultimate determinant of any company's policies: voting with your wallet is the surest way to evoke change. Despite trending hashtags, however, we will not know how real any purported cancellation surge is until Spotify announces earnings for Q1 2022, which won't happen for several months – although Ek and executives are sure to be grilled on the topic during the company's Q4 2021 earnings call on February 2. It's worth remembering that the #deleteUber campaign of 2017, for all of its apparent virality, turned out to be largely ephemeral: the company now holds a market capitalization of nearly $70 billion, a good reminder that Twitter is not the real world.

The latter group – employees – may turn out to be the more interesting part of the story here. Many inside the company appear upset at its content moderation policies, which should come as no surprise following similar headlines last summer: it's also telling that private internal communications are already leaking to the media, which is hardly ever a sign of all being well. The larger threat for Spotify, however, isn't media leaks or heated Slack discussions: it is the possibility that some employees would prefer to be at a company without the negative PR cycles. In tech, the fight for elite talent is both real and fierce, with employees driven more by the potential for equity appreciation than in any other vertical. Time will tell both how long this media narrative drags on for and if it impacts retention and recruiting, but this is worth keeping an eye on.

The True Cost of Content Ownership

If the Young vs. Spotify kerfuffle of the past week is giving you a sense of déjà vu, you're not mistaken: it was just several months ago that Netflix, the streaming leader in an adjacent vertical, was in the throes of a contentious debate over Dave Chappelle's latest standup special. Although the media formats differ, it's worth double-clicking on the similarity in these two crises, as they offer powerful insight into trends looming on the horizon for many content platforms at scale.

The common thread running through both scandals is that of content ownership versus mere aggregation. Just as Spotify pays Rogan for exclusive rights to his podcast, Netflix has a similar agreement for Chappelle's new standup specials – and this is where the problem truly lies for most consumers. While aggregation of hate speech and misinformation has certainly triggered protests and outcry in the past – Facebook and YouTube are no stranger to such controversies – it is the act of paying a creator for controversial and/or harmful content that produces the most fervent reactions in our public discourse, and which prompted Neil Young to revolt.

The irony here is that Spotify didn't need to end up in this unenviable position as it sought to aggregate the world's audio content. The company, in fact, has been fighting an uphill battle to normalize the concept of podcast exclusivity, often to the irritation of the format's largest creators; in the open-standards world of RSS feeds and free downloads which have characterized the rapidly growing medium since its inception, Spotify's aggressive takeover of intellectual property has long been a source of hesitation and resentment for many.

As if the Young vs. Rogan clash wasn't enough bad press for the platform to deal with, the company recently suffered public setbacks in its quest to not just aggregate – but rather own – the world's audio content. In January, Bloomberg reported on Spotify's recent struggles to produce engaging original content, news which was followed last week by headlines around troubles surrounding Harry and Meghan's much-hyped podcast:

As a musician, such headlines are both comical and infuriating. While the company ardently argues that it needs to pay musicians and songwriters less to stay afloat, it appears perfectly happy to light hundreds of millions of dollars on fire with unproductive original content partnerships and soccer team sponsorships, all while owned content is creating the platform's largest PR crisis in its 15 year history.

I'd like to offer an alternative strategy. Why not just pay the millions of active, high-output creators already on the platform – musicians – a bit more of a living wage?

At this juncture, it's worth noting one 'how-can-this-be-real' headline from the past weekend that epitomizes the mess Spotify now finds itself in: Harry and Meghan are now upset with the company as well.

Harry and Meghan call out Spotify following Joe Rogan controversy https://t.co/O6C9c6Euqs

— The Independent (@Independent) January 30, 2022

Why has Spotify chosen the ownership/exclusivity route with audio? It's impossible to say without being in the room when those decisions were made. An educated guess, however, would be exactly what I described in Streaming's Endgame Part Three: an aspiration to replicate the Netflix model, where per-stream royalties are no longer margin-destroyers hanging like an albatross over the company's earnings statements and future forecasts.

To understand where Spotify's content vision may have gone awry, however, we first need to understand a key nuance in the model of the company which it seeks to emulate. Netflix had to invest heavily in owned content because its original suppliers – film and TV production studios – quickly realized that they could spin up direct-to-consumer digital distribution channels (Disney+, HBO Max, Paramount Plus) without outside help. For Netflix, content ownership wasn't a strategic optionality: it was a survival imperative.

Spotify wasn't in the same position. It didn't just face zero practical risk of D2C disruption by its original content suppliers, the major record labels: it had an entire world of royalty-free, available-to-anyone podcast content to aggregate, curate, and advertise against without needing to own anything. Instead of competing on product and user experience alone, however, the company chose to fund expensive experiments with celebrities devoid of any experience in their chosen medium, while simultaneously taking exclusive control of The Joe Rogan Experience, a show with a long history of controversy and problematic guests and one likely to spark PR crises.

There is an alternate world where all of this could have been avoided: one in which Spotify invested in best-in-class solutions for podcast creators and consumers alike, offering an unmatched all-in-one platform for anyone looking to distribute or listen to audio or music content. Over time, as the leading aggregator for long-form audio, the company's unrivaled data operation would have been first to see podcasts gaining traction, offering an opportunity to directly back the most promising new creators and content houses; this is particularly key, as the company could have avoided big name celebrities likely to underdeliver and potentially problematic content and hosts.

Instead, Spotify now lies in a messy bed of its own making. Artists are increasingly furious at paltry payouts while podcasters receive hundred-million-dollar deals; listeners are up in arms over the company's funding of problematic content; and podcasters under exclusive deals are seeing their reach shrink, not grow.

Remarkably, these aren't even the worst of the company's problems. In its quest to buy out a previously un-ownable content format, it managed to create a high-stakes and costly battle with the richest tech companies in the world for exclusive podcast rights. Spotify, with roughly $3B in cash on hand, now finds itself in a zero-sum bidding war against Amazon – with $86B in cash – among others, in a market of its own making. If that group of 'others' starts to include a newly-aggressive Apple – a company essentially printing money, with $202B in reserves – the market dynamics of audio streaming could start to turn, quickly.

In a true bit of irony, the Q4 2021 earnings of the company it sought to emulate – Netflix – suggest just how expensive and ugly this fight is about to get.

Netflix Earnings

The tangible costs of content ownership

To fully understand the likely consequences of the content bidding war which Spotify has created for itself, we need look no further than Netflix's Q4 2021 earnings release last week.

From CNBC:

As usual, Ben Thompson at Stratechery offered excellent insight into the larger problem now facing Netflix. Spoiler alert: it involves fierce competition for both user time and expensive content in a hits-driven industry.

As Thompson notes, Netflix's most recent quarter was a conundrum: the company enjoyed massive hits including Squid Game, You, Red Notice, and Don't Look Up, many of which set records for streaming viewership. For growth to decelerate so rapidly during a period of massive hits is quite concerning – what happens when the hits dry up for a quarter or two?

The underlying issues here are twofold:

- Netflix is now reliant on non-stop hit generation from its content production and acquisition teams due to the plethora of streaming options it directly competes against (to say nothing of other mediums competing for user attention, such as video games).

- Due to Netflix's spending spree of the last decade, the cost of finding and producing these hits is now incredibly high and continues to grow, with more counter-parties in the bidding arena. Red Notice, the company's hit starring Dwayne Johnson and Ryan Reynolds, cost $200M to produce.

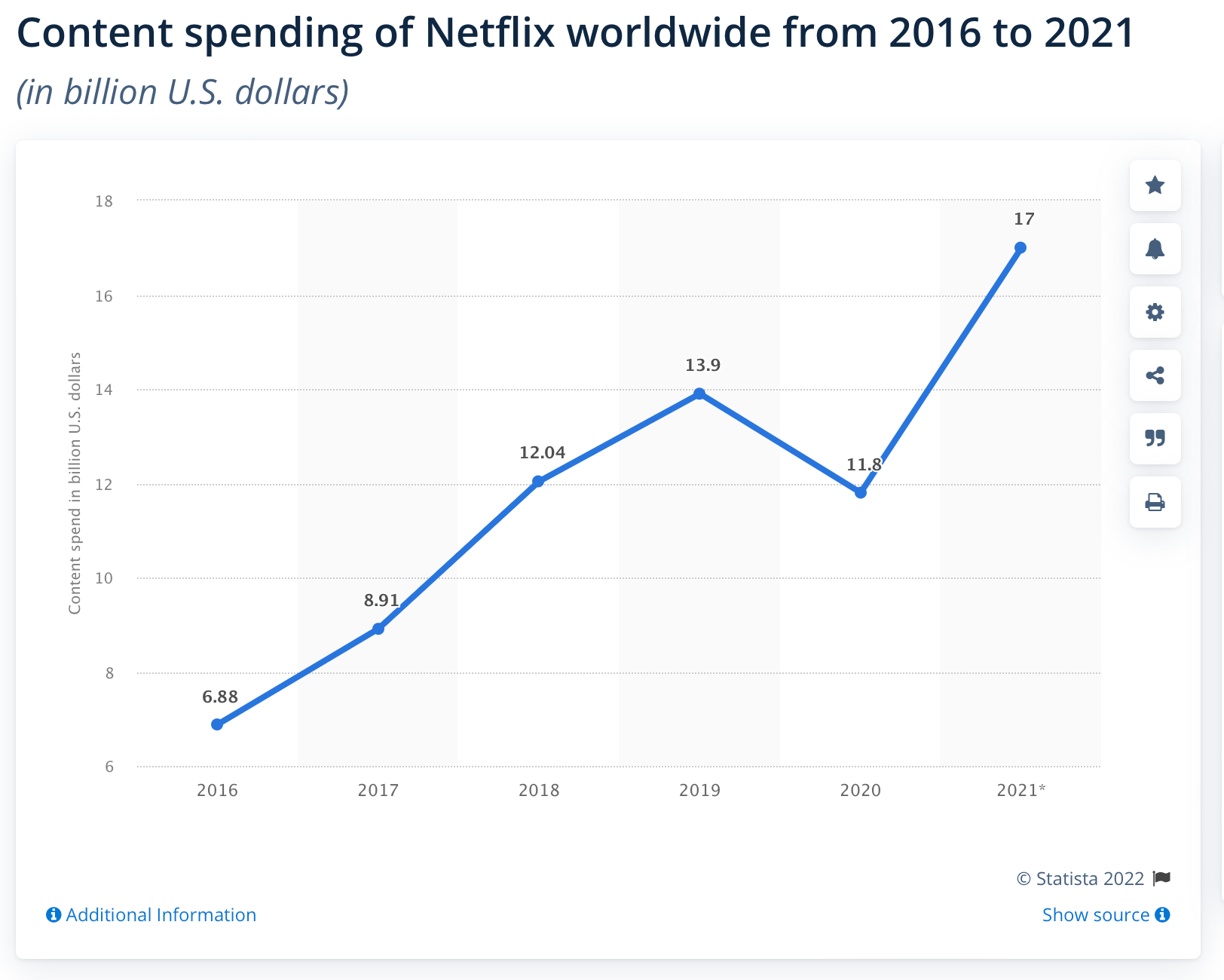

Just how rapidly are Netflix's costs increasing? The company spent $17 billion in fiscal year 2021, up from $6.88 billion five years earlier – an increase of 147%:

In the period depicted on this chart, the video streaming market has hardly remained idle. Disney+ obliterated its initial five-year growth goals in eight months, and HBO Max continues to draw widespread praise for its collection of best-in-class content – and this is to say nothing of two rather well-funded tech powerhouses, Apple and Amazon, that have likewise entered the marketplace.

The takeaway? Netflix's spending spree, which was potent enough to provoke a South Park episode at its expense, has now created a booming market for content acquisition, with the company facing off in a zero-sum bidding war against the richest companies in the world. This challenge is further compounded by the concurrent increase in competition from other streaming challengers. Content isn't just extremely expensive: Netflix must acquire and make the biggest hits to continue growing. Reed Hastings is as brilliant of an executive as there is in Silicon Valley, and I don't doubt the company's ability to navigate these turbulent times as well as humanly possible – but it will certainly be a challenge.

If this dynamic sounds familiar to the pickle Spotify may well have walked right into, that's because I believe both companies now find themselves in highly similar terrain. Consider, if you will, Spotify's new prospects in both podcasting and music:

- Music offers precisely zero differentiation from competitors, with all full-catalog streaming services (Apple Music, TIDAL, Pandora...) offering consumers an identical collection of content. While Spotify can in theory stand out in its data-driven curation of said content, many users seem quite happy with the curatorial skills of competitors such as Apple Music. Switching costs are likewise nearly non-existent due to the proliferation of apps and websites which can convert a user's entire library of saved music on one service to any other – in a matter of minutes.

- The one area where Spotify can differentiate itself – podcasts – is now a high-price, high-risk marketplace of its own making, with the company facing off against competitors who possess immense capital resources just as hits in the format are curiously drying up.

- The very act of content ownership – rather than aggregation – exposes the company to significant consumer risk, as the Young vs. Rogan dispute shows.

In its pivot to podcasts, Spotify sought to shift away from the razor-thin margins of streaming music towards the royalty-free utopia of 'audio'. While time will tell, it now appears that this change may have the opposite effect: the company is likely to face ballooning content acquisition costs for top-flight talent, all while exposing itself to customer revolt and negative PR cycles. Meanwhile, the platform runs the very real risk of being the only full-catalog streamer to not offer consumers every song ever made, if artists continue pulling their works over payout rates and/or problematic content.

My takeaway? The battle for market supremacy in music streaming is about to get a whole lot more interesting.

Disinfo Is Winning, Everywhere

Let's all just slow down a bit.

One of the more bizarre aspects to the Young vs. Spotify controversy is the speed with which a protest catalyzed by disinformation is becoming subsumed by it. On Friday, amidst the fallout from Young officially leaving the platform, I took particular interest in a viral tweet from Tristan Snell:

BREAKING - Spotify is no longer letting people cancel subscriptions.

— Tristan Snell (@TristanSnell) January 28, 2022

Great tweet! Short, spicy, all caps lead-in reminiscent of a CNN ticker, and 30,000 likes. There's just one problem: it doesn't appear to be true. Rather, Snell appears to be (intentionally or unintentionally) conflating another a related viral tweet:

BREAKING: Spotify has shutdown its live customer support due to an unprecedented number of complaints after they doubled-down on their Joe Rogan anti-vax campaign pic.twitter.com/yscw97xTkt

— LeGate (@williamlegate) January 27, 2022

The problem with Snell's claim is that what LeGate was referring to – Spotify's customer contact portal being overloaded – is not the same as the company denying cancellations to members. Rather, cancellations are very much permitted using the aptly-titled 'Cancel Subscription' button on Spotify's website, and customers do not need to contact the company to terminate their premium plan (unlike some other large publishers who engage in much-criticized dark patterns).

Likewise, Snell's claim that Spotify was engaging in nefarious business practices by not letting users cancel in its iOS or Android mobile apps is completely misguided: the company hasn't let users unsubscribe or subscribe in mobile apps for years, due to Apple and Google's mandatory 30% App Store take, as I've previously noted. If a company doesn't let you hand them money in a given application, it becomes a bit harder to see their lack of subscription management features in a negative light:

If you haven't subscribed to a streaming app like Spotify/Netflix recently you may not be aware, but this policy has resulted in a bizarre ecosystem where most apps only 'hint' at web subscriptions, if at all.

— Dave Edwards 🎧 daveedwards.sol (@itsDaveEdwards) September 2, 2021

This is what Spotify does: pic.twitter.com/ZTQichClsx

Snell wasn't the only one guilty of intentional or unintentional misinformation for engagement, with numerous media outlets also running poorly-contextualized stories about how Spotify's stock was collapsing due to Young's protest:

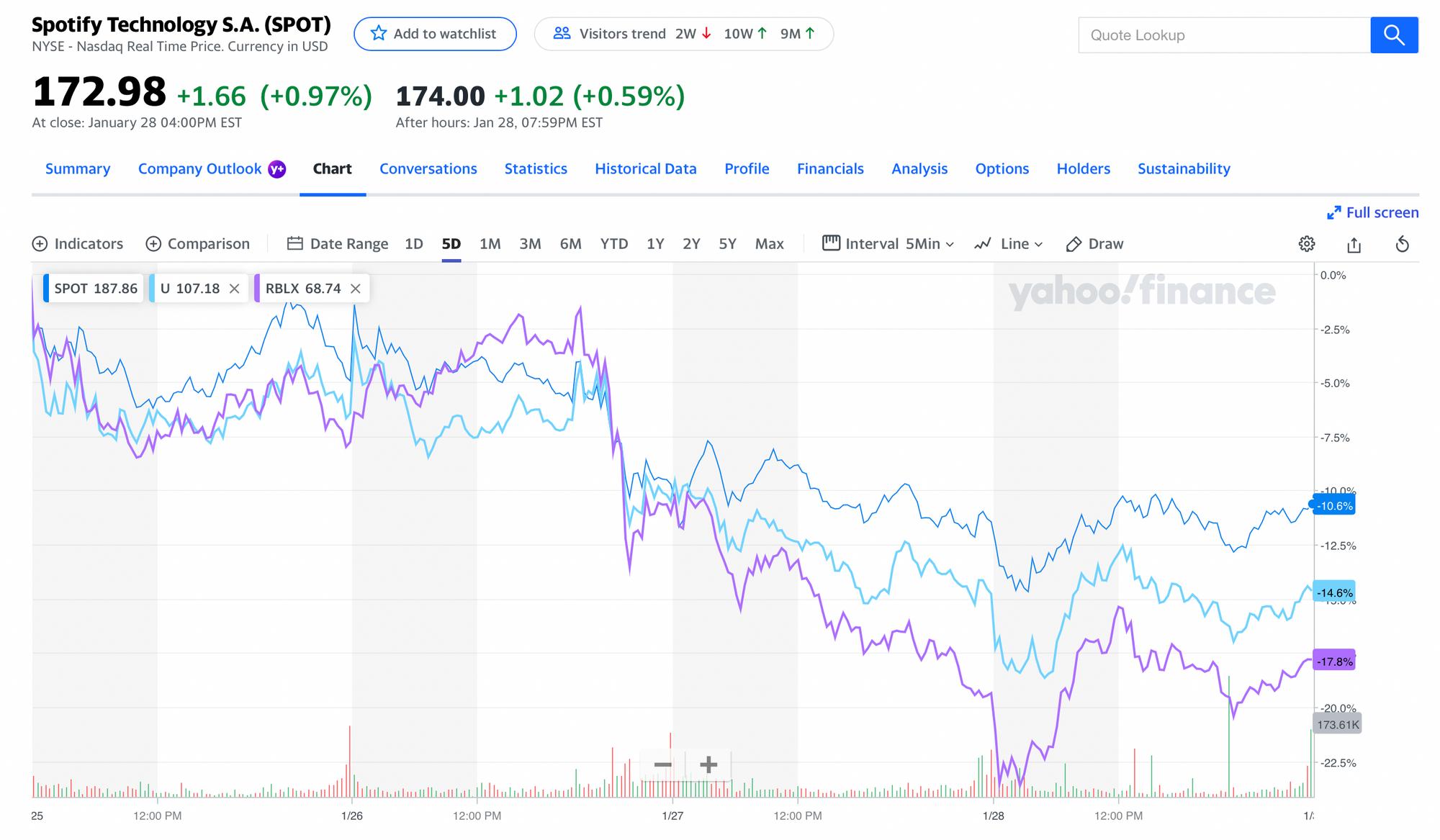

Is the Variety headline true? In the sense that Spotify's stock sold off last week, yes. Just one problem, however: nearly all high-flying technology stocks were hammered in January due to looming interest rate hikes. Many strong tech stocks including Unity and Roblox – companies not in the midst of PR crises – dropped last week as well, following a highly similar chart pattern to that of Spotify. Note that on a chart overlaying the three ticker symbols, they drop in unison and Spotify actually drops the least of the three.

My goal here isn't to dunk on people, because nobody is perfect – I've certainly gotten things wrong before myself. Rather, my intention is to ask everyone to slow down, if only a bit. Misinformation is eating our digital world, and it is alarming how susceptible we all are (myself included) to its ever-expanding grasp. The next time you're tempted to retweet that spicy take, hot headline, or provocative podcaster for something that seems to fit a narrative just a bit too well, please take a breath and see if it's true first.

Closing Thoughts

Where do we go from here?

In Streaming's Endgame, I noted that the reason my focus largely rests with Spotify in discussing our industry is because of the company's market-dominating position: the ways in which the platform compensates, enables, and treats artists holds truly outsized power over the livelihood of said creators compared to its competitors.

Last week, however, it really did begin to feel as though a shift might be underway. There seems to be a newfound willingness to confront the company that I haven't seen since it rose to dominance in the last decade, and consumers, not just artists, appear to be souring on the Spotify's stance across a range of hot-button issues.

What will the end result be? It's far too soon to say. The odds, in my opinion, still favor Spotify continuing its steady march to dominate the music and audio verticals, with Neil Young's protest becoming a cultural blip – rather than an existential financial threat – in the company's story. But the door through which a competitor could enter is most certainly much more ajar than it was just two months ago: the ultimate determinant of the outcome, it seems to me, may well be just how bad Apple or Amazon really wants this business.

I'll be back in a few weeks time with an in-depth look at the bubbling Creator Economy, and I hope you'll join me then. In the meantime, you can find some fun, thought-provoking, and mind-blowing things to consume on my Reading List, or keep up with my daily thoughts on the music biz on Twitter.